I am like you. I grew up in at best a lower middle class family. I remember the early 70’s. My Dad getting laid off work. Funds were scarce. I remember the fear as a kid of not having money.

My parents taught me to save, but also do my best. I took some big risks in life. I wrote a check amounting to most of my savings to start a business at 32. It could have been a disaster, but it wasn’t. I ended earning millions from that risk.

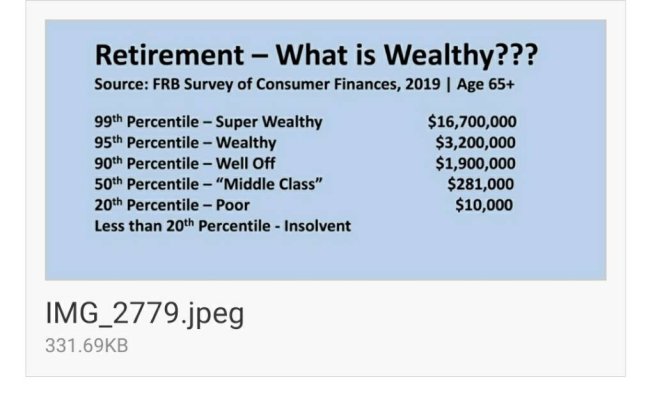

I feel I lived the American Dream. By the scale shown, we are considered wealthy. I am proud of that. I don’t flaunt it, but don’t hide it either. There’s nothing wrong with wealth despite what some would have you believe. My now dead parents would be very proud of what I have done. We live well and our charities (we have no kids) will be better off when it’s our time to pass.

I grew up in a middle class west London (UK) home, Mum did not work till later in life. They managed to put my 2 sisters and myself through "Private " School (Called Public in the UK, the opposite of the USA). They did have a second home in Malta where they spent their holidays, but I would hardly say they were rich. It was not them who taught me about money, it was my Sister GRHS, it was with her tutorage that I came up with and published my 10 Rules for retiring early, with one extra as a bonus.

1. "Pay yourself first" (I invented this phrase in the late 1980's) before Suzie Orman did, she just made a ton of money from it, the story of my life) I do agree with most of her ideas. This means save for retirement first, then spend. We both put MAX into our 401K funds a long as we were eligible working in the USA, from 1988 onwards. My recommendation is 30% of income where possible. This is what we did, only tapping it for large bills like, home and auto insurance, and house taxes.

2. "Make goals and honor them" We made a commitment towards early retirement early in our relationship. Basically a year after we were married, we both had similar goals in this area. It is important to make goals and exceed hem where possible.

3. Save your "Not Money", do not waste it. "Not Money" (I should trademark the phrase, but It was my sister's invention) is money you earn or make that is not part of your daily routine. for example. a Bonus is Not Money, If you have a hobby that is not your major source of income, the profits are Not Money, if you win a lottery, that is Not Money, If you sell your lawn mower at a garage sale, that is Not Money, A Tax REfund in Not Money. We either put ours into our home by reducing mortgage payments or into our retirement nest egg.

4. "Live within Your Means" Simply put do not spend more than you earn.

5. "Do NOT Live off Credit" We do not care what a credit card's interest rate is, we NEVER have to use it. PAY IT OFF at the end of the month... PERIOD! We only have 2 credit cards, an AT&T Universal MasterCard Rewards and a Delta Skymiles Rewards Amex. The reasons I am sure are obvious. By the way we use them for everything, groceries (even $5.00 dollars worth) ANYTHING we can pay by credit we do NO EXCEPTION, we simply pay it off every month. In all our lives we have NEVER been delinquent on any bill at all. If we do not have the money we do not spend it. Simple, but effective.

6. "Capitalize in Your Own Situation" All of us are different, we all have different ways of earning money. In my case, I was paid 85% salary 15% commission, I traveled extensively and my expenses were covered at actual. I used to always use my own credit card for expenses. Why let the company get the credit rating? I paid all my expenses from my salary, when the expense check came it went into my Nest Egg. The only time we touched the Nest Egg was as mentioned earlier for large bills. But in General this was one the main ways I used to save. Some people use Direct Deposit, I used my expense money. Oh and by the way we have an excellent credit rating to this day.

7. "Do Not Go Without" Simply buy wisely and save for larger luxuries. I have had many Sports cars (My passion as a younger man) and toys in my time. I never borrowed to get them. I always had a "Car Money" account for the big toy car, when I sold it, the account was revived again. The only time we got any form of long term credit was when a vendor offered a 1 or 2 years same as cash (No Interest). Then we paid it off on the due date. An example of these types of spending were, a 55" Big Screen TV ($3700), A solid wood Bedroom Suite (~$3000) and so on. All other major items, and there were many, were purchased with a credit card and paid off in full at the end of the month. We purchased them just after the invoice from the credit card company so we got the full month to pay.

8. "Let the Government Help" This works as part of Rule 6. As a commissioned sales person, I was able to write off my company car, home office and other business expenses that were solely used for business. As I worked mostly from home, and had a private car for personal use, this was a no brainer. I must disagree with Suzie Orman on this one. I leased my cars that I used for work for as long as I can remember, and they were good ones too. Lexus 400, Acura Legend, Audi S4 etc. All Brand New. They provided me with an excellent source of deductions. As I only did about 10,000 miles per year, I could always sell the car privately just before the end of the lease (about 3 months) and usually make more than enough to pay off the lease early.

9. "Relax Take a Vacation" We always put aside money to relax, we took nice vacations, just not EXPENSIVE ones. We did however go to Australia, New Zealand, Hawaii, Korea, Indonesia (Bali), Singapore, Thailand and Europe. We took some Cruises. We just budgeted carefully. Again, we NEVER went without.

10. "Preserve Your Capital, Sleep at Night" This is more applicable as you get closer to retirement. I find it a lot harder to make money once it is lost or spent as opposed to preserving it in the first place. Almost anyone can save a little. We just settled for less interest than the risky investments.

11. "Read The Millionaire Next Door" If I was to choose a publication, it would be this one. As all books, it exaggerates the extremes. However, if you drive gown the middle of the road, so to speak, it will guide you to retirement. I would say it is a must read along with Bernstein's "Four Pillars of Investing"