DawgSavr

Dryer sheet wannabe

- Joined

- Jul 13, 2021

- Messages

- 24

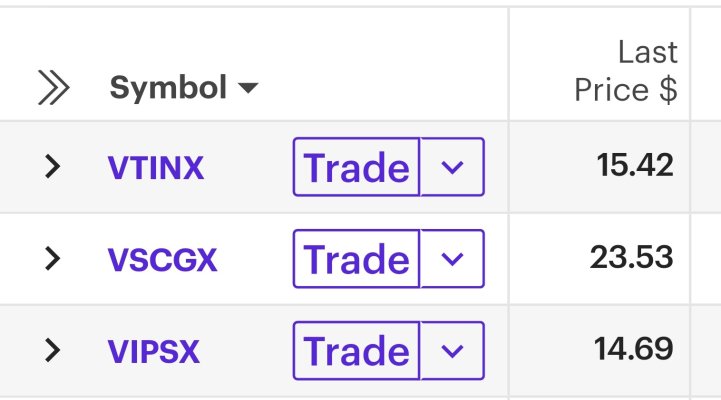

Good afternoon. Curious where folks are parking their respective cash reserves. Currently have ~$200K sitting in a Vanguard Federal Money Market Fund. At 57 and looking to retire at end of year, the purpose of this money is to keep it liquid and be able to cover ~3 years of expenses, ride out any market downturns or emergencies. My allocation is 65% equities, 30% fixed and 5% cash. Would like to keep it as liquid as possible and within Vanguard. Suggestions?