Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

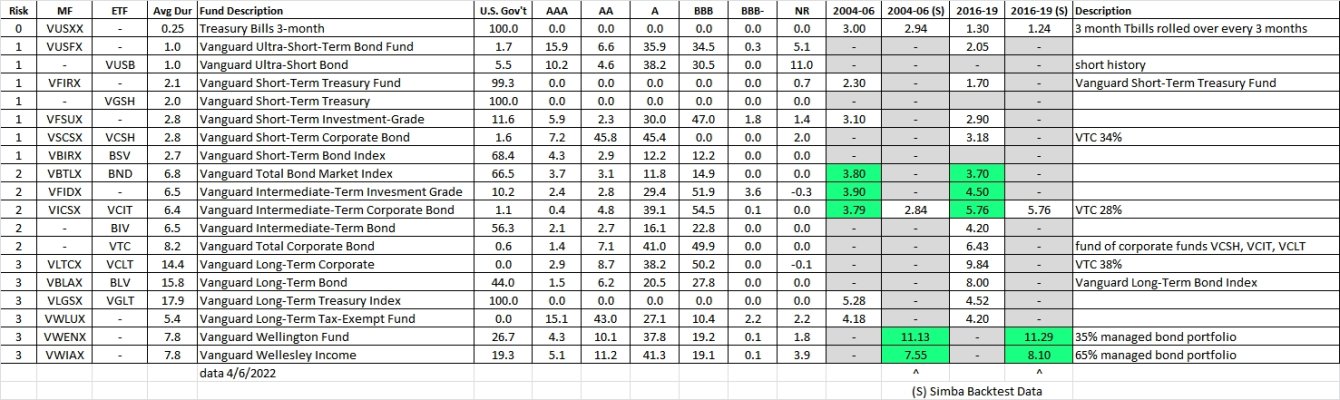

We have had two periods of Fed Funds rate being ramped up by the Federal Reserve. The 3 month Treasury bills closely follow these ramp ups. These periods were roughly the 2004-2006 period and the 2016-2019 period. Here is a chart of the Fed Funds rate showing the two periods (yellow highlighted):

The Fed has just last week embarked on another planned ramp up. The Fed meets 8 times per year and they have announced their intention of bumping up the rates, probably at each meeting going forward.

Which bonds out of the choices presented did the best in those two past interest rate ramp ups? I will show the past results in a few days to give time for your guesses.

Caveat: I am not suggesting history will exactly repeat going forward but it is interesting to know what worked in the recent past.

The Fed has just last week embarked on another planned ramp up. The Fed meets 8 times per year and they have announced their intention of bumping up the rates, probably at each meeting going forward.

Which bonds out of the choices presented did the best in those two past interest rate ramp ups? I will show the past results in a few days to give time for your guesses.

Caveat: I am not suggesting history will exactly repeat going forward but it is interesting to know what worked in the recent past.

Last edited: