Sigh ... I have no idea what you are trying to argue here, but your arithmetic is correct only if all participants' portfolios are identical in size.

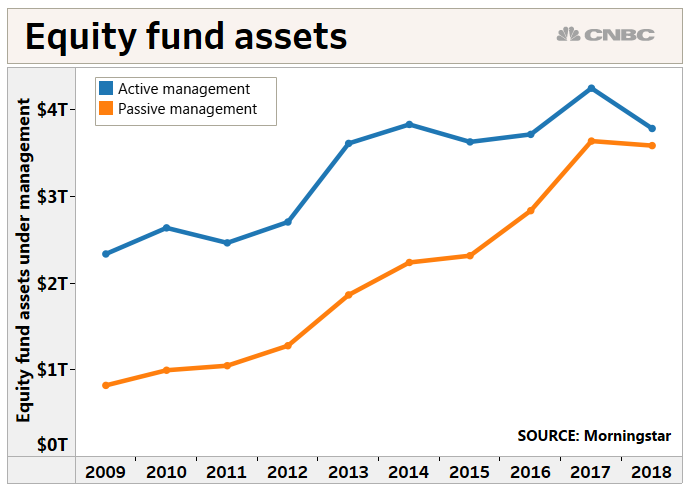

You also consistently conflate passive investing with S&P 500 index investing. While it is possibly true that retail investors are overweighting that sector, it is definitely true that the majority of passive money (typically institutions like state pension funds) is not so naive.

IF you want to understand where money is coming from look at the money in S&P 500 it is 80% of the US market, the S&P500 may be different from the other 20% but it is still 80% of the market and growing as a percentage of the total market. This is because when anyone invests in VTI 80% goes to S&P500 when they invest in S&P500 they invest 100% in S&P500 leading to overinvestment in S&P500. Or are you saying pension funds are so smart they don't go to where the majority of investment dollars go.

If the S&P is in fact mispriced, which can be debated, this will get sorted out just like any other mispricing -- by the active managers. Not to worry. I do not feel you will ever worry about pricing which is the point, you are counting on a diminished market presence to set a price when money is just flowing on an increased basis into the market.

Another implicit assumption in your arguments is that money coming under passive management is all new money. No this is not my assumption at all, the assumption is that Passive money is replacing active money, I thought that was pretty clear, new money from young investors is nearly all passive, the money being sold by older investors is much more active. The result is more passive activity and the end result will be market moves will be determined by cash needs and not market valuation and in the coming next couple years those flows should be positive leading to even more of a positive uptrend. It is not, as any of the various mutual funds flow charts will confirm. Active investors in aggregate probably end up buying the whole market as they hunt for winners, so when investors switch to a passive strategy and sell out their active managers, in aggregate the stock the active managers sell will be pretty much the same stock that the passive funds will buy. IOW, primarily no new money, no new-name stocks purchased, and little market impact. Since active money on balance average 3% cash and passive has no cash, every time an active investor sells there is more cash going into equities than existed before, if an active investor sells a portfolio that is tilted to one stock and buys a passive index, it is the passive index that changes it's market capitalization to keep the same percentage of valuation for all the stocks in the index, not that every stock in the index is being bought. Think of it this way, suppose a giant pension fund held billions of dollars in small stocks and decides to drop active investing and moves into VTI. Prior to selling Passive owns a percentage of the total market and by definition active owns the remainder in equal proportion to the passive. After the selling the same will be true even thought the active investor only sold a portion of the total market, the total market is redefined by the index to account for the change in ownership by rule, it is the passive market determining the rules and capitalization not the active. AND THE S&P500 will be the major beneficiary of this move because of the market capitalization of the S&P500. Passive investors will merely think that small stocks are being valued less by active investors when in truth they are just leaving the market