Hello,

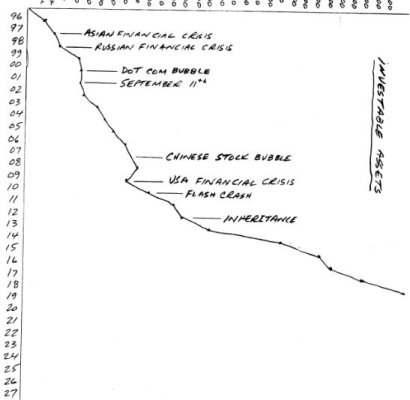

So the market is at new highs, I don't recall this before. Excited yet have some fear.

Firecalc shows great success from here if we retire now, perhaps even dying with 5-10 times the money we have now. Can this really happen? Have you lived through previous new highs and seen your $$$ grow? Especially in retirement? If you retired having "x" amount of dollars, what portion of "X" do you still have, over what time frame?

30% higher from here is the FIRE point for me psychologically.

Thanks for sharing!

So the market is at new highs, I don't recall this before. Excited yet have some fear.

Firecalc shows great success from here if we retire now, perhaps even dying with 5-10 times the money we have now. Can this really happen? Have you lived through previous new highs and seen your $$$ grow? Especially in retirement? If you retired having "x" amount of dollars, what portion of "X" do you still have, over what time frame?

30% higher from here is the FIRE point for me psychologically.

Thanks for sharing!