happycampr

Dryer sheet wannabe

- Joined

- Oct 3, 2016

- Messages

- 12

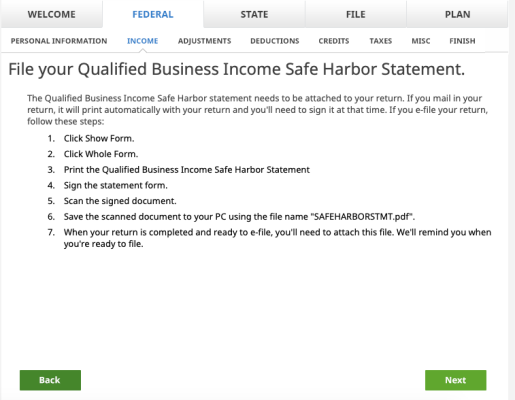

Just wanted to save others the hassle I ran into trying to attach the signed Qualified Business Income statement when e-fling with H&R Block (downloaded software-not online version).

Attached is copy of the instructions provided during the interview that led me to believe that the statement needed to be attached prior to hitting the final submit button for e-filing. Actually, you have to hit the final submit and then you are finally prompted to attach the statement.

This may be intuitive to most of you, but I wasted a lot of time talking to the H&R Block help desk (not helpful) to find out how to get the statement attached before submitting. Finally just decided to submit anyway (and wait for IRS to request the signed form) and discovered that only after submitting are you prompted to attach.

Attached is copy of the instructions provided during the interview that led me to believe that the statement needed to be attached prior to hitting the final submit button for e-filing. Actually, you have to hit the final submit and then you are finally prompted to attach the statement.

This may be intuitive to most of you, but I wasted a lot of time talking to the H&R Block help desk (not helpful) to find out how to get the statement attached before submitting. Finally just decided to submit anyway (and wait for IRS to request the signed form) and discovered that only after submitting are you prompted to attach.