godoftrading

Dryer sheet aficionado

- Joined

- Apr 20, 2008

- Messages

- 36

Do you know that the US government gets more of the money from gasoline sales than any of the oil companies? Let me walk you through this:

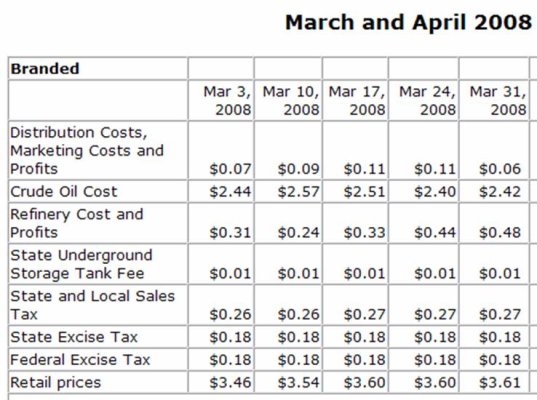

Exxon's profit margin is 11.23%, so at $3.50/gallon Exxon gets 39 cents, this is after the US government taxed their profits; $29 billion from Exxon alone, 41% of their profits. The US government earned 27 cents per gallon off Exxon

Then there is the federal tax of 18.4 cents per gallon. State taxes average 28.6 cents per gallon, so in direct taxes on your gas, 47 cents goes to the government.

Add in the taxes on oil companies and 74 cents goes to the US government versus 39 cents to Exxon, almost double. So who should the "windfall" profit tax be on? The entity that produces and delivers the gas or the one that does nothing at all? Who is really "gouging" you at the pump? This is after the US and State governments have taxed your income, made you pay for a drivers licenses and tabs for your car, among many other things.

****Please note the numbers on Exxon assume that all they do is sell gasoline. I still believe the argument is valid.

Exxon's profit margin is 11.23%, so at $3.50/gallon Exxon gets 39 cents, this is after the US government taxed their profits; $29 billion from Exxon alone, 41% of their profits. The US government earned 27 cents per gallon off Exxon

Then there is the federal tax of 18.4 cents per gallon. State taxes average 28.6 cents per gallon, so in direct taxes on your gas, 47 cents goes to the government.

Add in the taxes on oil companies and 74 cents goes to the US government versus 39 cents to Exxon, almost double. So who should the "windfall" profit tax be on? The entity that produces and delivers the gas or the one that does nothing at all? Who is really "gouging" you at the pump? This is after the US and State governments have taxed your income, made you pay for a drivers licenses and tabs for your car, among many other things.

****Please note the numbers on Exxon assume that all they do is sell gasoline. I still believe the argument is valid.