TimevsMoney

Confused about dryer sheets

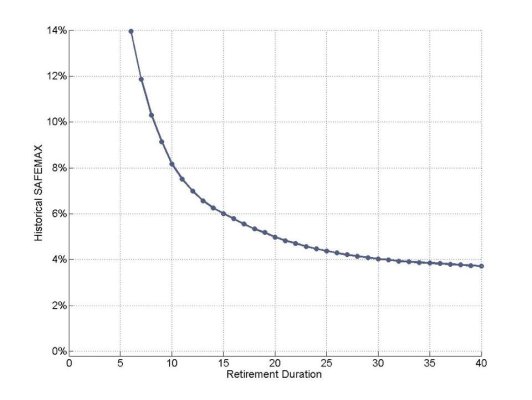

I have heard many financial experts suggest we can safely withdraw up to 4.0% a year and likely be ok. My question is this: is that 4.0% based on the beginning balance of the portfolio? Or based on the adjusted balance each year? I am 58 and considering retiring in 2 years at 60. With a current 2.0 million portfolio mostly in a 401K pre tax plan that would be $80K a year. (Annual Retirement budget roughly 120K a year which includes 25K for health insurance). Any advise on that 4.0% from you veterans at this withdrawal business would be greatly appreciated.