googily

Full time employment: Posting here.

- Joined

- Jul 6, 2013

- Messages

- 792

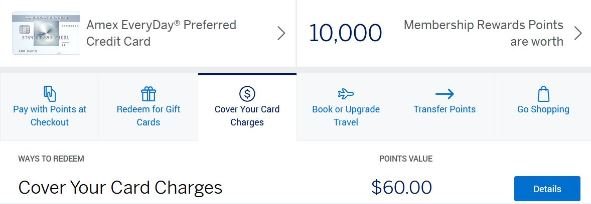

I went whole hog on sign up bonuses over the summer. Got the Capital One Savor 4% dining, $300 bonus, Chase Sapphire Reserve for 3% points on travel and dining and a 50k points bonus. Got the Amex Blue Preferred for 6% groceries and streaming, and got $150 back. Got the Chase Freedom for 5% back on certain categories, and a 15k point bonus. Got the Amex Hilton Surpass, giving points for Hilton stays plus a 130k point bonus and Gold status. And then the Chase Freedom Unlimited for 1.5% on everything. And have had the Amazon Prime 5% card for a year or so.

(I had a big yard project that made it easy to quickly hit the minimum spends.)

The handy thing about the Chase points is that I can move the points from the Freedom cards to the Reserve card and then they are worth 1.5 points when redeemed for travel, which makes the Freedom Unlimited the equivalent of 3 points per dollar.

My cards had all been Citi for a long time, but I was not happy when they ditched the travel protections.

I also opened Chase checking and savings accounts for the $600 bonus.

I use Google Pay whenever I can, so using the "right" card isn't all that hard.

(I had a big yard project that made it easy to quickly hit the minimum spends.)

The handy thing about the Chase points is that I can move the points from the Freedom cards to the Reserve card and then they are worth 1.5 points when redeemed for travel, which makes the Freedom Unlimited the equivalent of 3 points per dollar.

My cards had all been Citi for a long time, but I was not happy when they ditched the travel protections.

I also opened Chase checking and savings accounts for the $600 bonus.

I use Google Pay whenever I can, so using the "right" card isn't all that hard.

Last edited: