So, after playing around with my budgets for the umpteenth millionth time, I noticed something interesting. It appears with some minor lifestyle changes (primarily selling a lightly used non-income generating parcel of land) that a 4% withdrawal rate from only my taxable accounts covers all of my necessary expenses and even a little bit of non necessary (read beer, motorcycle, and boat) expenses!

Also, if I include my tax advantaged accounts, the withdrawal rate is under 3%! My plan has always been to set up the taxable accounts at about a 60/35/5 allocation and draw on this until I can easily tap my tax advantaged accounts. My tax advantaged accounts are a bit more agressive (around 70/30) as I don't plan on touching them for about 18-20 years at the soonest. I know, everybody says to look at the overall allocation, but I think very early retirees (I'm 42 now) need to look at things more like the "before 60 funds" and the "after 60 funds"

Anyway, if we assume I have 1MM, I would have 300k in tax advantaged and 700k in taxable. I would like to draw about 4% from taxable for about 18-20 years, then start tapping tax deferred which would have hopefully at least doubled by this time, and start looking at Social Security.

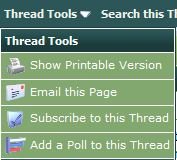

Now, don't think I'm just planning on quitting right now, I consider myself to have just breached the edge of FI. My question is (and if I knew how to make a poll, I would have) is how you would feel about retiring drawing on your accounts as such, ie, AM I FI ??

??

Also, if I include my tax advantaged accounts, the withdrawal rate is under 3%! My plan has always been to set up the taxable accounts at about a 60/35/5 allocation and draw on this until I can easily tap my tax advantaged accounts. My tax advantaged accounts are a bit more agressive (around 70/30) as I don't plan on touching them for about 18-20 years at the soonest. I know, everybody says to look at the overall allocation, but I think very early retirees (I'm 42 now) need to look at things more like the "before 60 funds" and the "after 60 funds"

Anyway, if we assume I have 1MM, I would have 300k in tax advantaged and 700k in taxable. I would like to draw about 4% from taxable for about 18-20 years, then start tapping tax deferred which would have hopefully at least doubled by this time, and start looking at Social Security.

Now, don't think I'm just planning on quitting right now, I consider myself to have just breached the edge of FI. My question is (and if I knew how to make a poll, I would have) is how you would feel about retiring drawing on your accounts as such, ie, AM I FI