It's done that way in the UK, but their rules for individual taxes are a lot simpler. I think I'd rather stick with the present (bad) method than be forced to prove to the IRS that their figures are incomplete/wrong every year.If the IRS is collecting data in paperless fashion from all sources, it should be a simple matter for their computer to total my numbers, and send me a bill for whatever I owe. If there are certain non-reported elements, such as deductable expenses, I can file just that data. Now THAT's what I'd call paperless.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

IRS Going Paperless?

- Thread starter JOHNNIE36

- Start date

JOHNNIE36

Thinks s/he gets paid by the post

what if you get audited?

I e-file every year but I can print out my returns (TT)

Well, they provide a copy for your records but they don't want to print out a return for you to file and mail with a check. They want you to do it electronically. Pretty simple and upfront.

Last edited:

JOHNNIE36

Thinks s/he gets paid by the post

I volunteer with the IRS Tax assistance program, same program as AARP sponsors. We don't require efile, it is at option of taxpayer. We ask if the client wants to efile and let them know if that they will get their refund faster by efile. In fact some returns cannot be efiled so we let them know that they have to file by paper return. I'd be curious if AARP requires efile or if this volunteer just didn't know what he was talking about.

No, this return was confirmed by the AARP overseer, the representative in charge. It didn't make any difference to me, in so much as I was going to pay anyway. They just didn't want to print out a paper return for me to send in with a check. That would be paperwork. They wanted an efile and electronic deduction from my checking account. It was actually easier for me to do it this way. It's just funny in how they pushed you to do it their way. You had to pay by 4-15 anyway. I was prepared for this. Some people may not be.

Last edited:

The IRS is requiring any office (ERO) that files over a certain number of returns (can't remember the number) must use efile. If a client wishes to mail in the return, the office must ask the client to sign a special form (that they need to keep on file) stating that they opted out of e-file. Making the path of least resistance and hassle to use e-file. So if you go to a preparer, they will strongly encourage e-filing. Of course, if you do your own, none of these rules apply.

I have had the case personally where a form didn't get scanned or entered into the computer system after I mailed in a paper return. Spent 3 months in correspondence with the IRS (I won) because of a lost paper form. I now e-file (through my free copy of TT).

I have had the case personally where a form didn't get scanned or entered into the computer system after I mailed in a paper return. Spent 3 months in correspondence with the IRS (I won) because of a lost paper form. I now e-file (through my free copy of TT).

I think I'd rather stick with the present (bad) method than be forced to prove to the IRS that their figures are incomplete/wrong every year.

+1

In the USA you are innocent until proven guilty, except when it comes to the IRS and SEC.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

As much as I like and support eFile/paperless, I do agree with this aspect. I eFile because I get it [-]free[/-] "at no charge" from Vanguard with TurboTax. I also get a free State package, but not state eFiling. So I dutifully fill an envelope with state forms and send it in at the last possible minute vs paying the state $15 for something that has to be much easier for the state...go figure. My futile gesture.Amen. The IRS pushes e-filing as being easier, more accurate, and saving the government money, so why not make it free? Because (IIRC) the IRS cut a deal with tax prep software makers not to make their own govt efile system but instead to use the commercial system(s) that belong to the software makers. It's simply a way to offer them a govt-sanctioned monopoly. And giving away free tax-filing to low-income folks just adds insult to injury--what kind of cr*p is that? Make it easy and free for low income people to comply with a government mandate, but everyone else will be forced to pay postage or buy software? If e-filing saves taxpayers money, why doesn't the government make it free and convenient for everyone to do it?

I've filed on paper before as my own little rebellious (and futile) "stick-it-to-the-man" gesture.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Or maybe simplify the tax code. But I'm not holding my breath...If the IRS is collecting data in paperless fashion from all sources, it should be a simple matter for their computer to total my numbers, and send me a bill for whatever I owe. If there are certain non-reported elements, such as deductable expenses, I can file just that data. Now THAT's what I'd call paperless.

One minor change...+1

In the USA you are innocent until proven guilty, except when it comes to the IRS, SEC and DW

I am all for the IRS or any government agency improving efficiency and reducing costs, now more important than ever with our deficits.

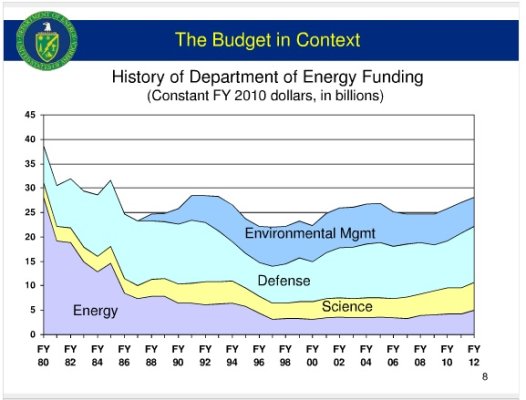

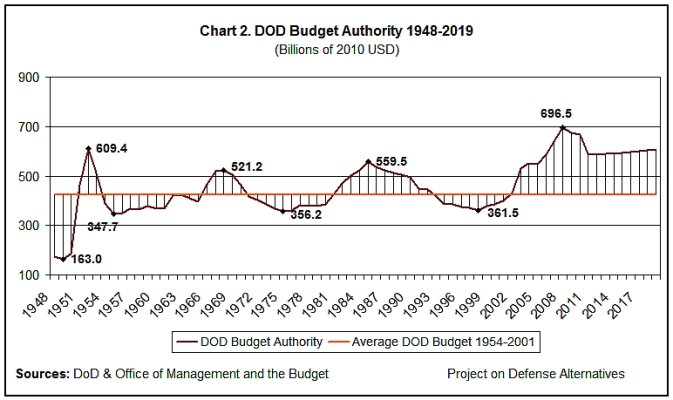

I don't know when I've ever seen a government agency's budget go down, so as far as reducing costs, where does that show up?

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I agree it feels that way, and I assume you're kidding so just a few...I don't know when I've ever seen a government agency's budget go down, so as far as reducing costs, where does that show up?

Attachments

packrat44

Thinks s/he gets paid by the post

I am willing to go paperless when filing my 1040 when the IRS is willing to go paperless in their restrooms.

EvrClrx311

Full time employment: Posting here.

- Joined

- Feb 8, 2012

- Messages

- 648

I am willing to go paperless when filing my 1040 when the IRS is willing to go paperless in their restrooms.

funny you should say that... waterless urinals are the new craze around here (environmental plaques and all)

I would do the e-filing if the IRS and state gave me a free software package to do it. As close as I can tell, I need to pay somebody to e-file (at least for the state form). That doesn't seem right.

Amen. The IRS pushes e-filing as being easier, more accurate, and saving the government money, so why not make it free?

IRS does provide a free way to efile: www.freefilefillableforms.com

You don't need to print anything out to snail-mail...

This would be useful to the small number of people still using paper forms but who also are comfortable with using computers and the internet. It won't do anything for the majority of folks who do their own taxes using TurboTax, HR Block At Home, Tax Act, etc. Nobody is going to re-type everything into those IRS forms.IRS does provide a free way to efile: www.freefilefillableforms.com

You don't need to print anything out to snail-mail...

Payin-the-Toll

Recycles dryer sheets

GrayHare nailed it! Government has all of our numbers on computer, so why not just send us a bill or mail us a check? Definitely need some type of tax reform--Hope we get it by the time my grandkids are filing so they don't have to go through this crap once a year.

GrayHare nailed it! Government has all of our numbers on computer, so why not just send us a bill or mail us a check? Definitely need some type of tax reform--Hope we get it by the time my grandkids are filing so they don't have to go through this crap once a year.

Because the tax code is too complicated. e.g. the government doesn't know how much you donated to charity, if you installed energy efficient windows etc, etc

All the time we lived in the UK we rarely filed a tax return. Each year we'd get a statement from the taxman showing our income and deductions and how much we owed them or they owed us.

This would be useful to the small number of people still using paper forms but who also are comfortable with using computers and the internet. It won't do anything for the majority of folks who do their own taxes using TurboTax, HR Block At Home, Tax Act, etc. Nobody is going to re-type everything into those IRS forms.

Independent said:

So I replied indicating that IRS does provide that option. I thought you were supporting what he said but I guess your main complaint is not lack of free efiling (even though that's what you mentioned), but complicated calculations one has to do without additional software...I'm still filing on paper.

<snip>

I would do the e-filing if the IRS and state gave me a free software package to do it.

I am on board with that... but for those that don't know, I figured I would mention there is a free efiling option...

As for noone using it, well, it seems like at least both Independent and myself would consider using that as well some others mentioning this on other threads... And again, I am all for flat and/or auto-deducted tax - it's a shame population has to spend all this time and resources on filing taxes each year.

Free To Canoe

Thinks s/he gets paid by the post

What special form? I see nothing in the instruction booklet. And 1040-V, a relatively new form (the payment voucher form), is not required either.

"Form 8948 must be filed by a tax return preparer by law to e-file any "covered" return that can be e-filed but chooses to paper file the return instead.

This is for retail preparers who file 11 or more returns."

I work for H&R Block this season and this is directly from their literature.

They are encouraging efile for many reasons.

Free To Canoe

Thinks s/he gets paid by the post

GrayHare nailed it! Government has all of our numbers on computer, so why not just send us a bill or mail us a check?

This is what my friend, who owned his own tax preparation service for many years thought. He sold the business years ago.

Nothing is so complicated that it cannot be simplified. The problem is that the code keeps changing every year.

The reason it keeps changing is that this is the primary tool that the govt has to modify our behaviors. It is not just about the money. They will never let that go. Since political power is constantly changing hands so will the need to change the modification tool (tax code).

Modern people are not smarter than traditional people, they are just different in their ways. There will always be a need for tax preparation help.

scrabbler1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 20, 2009

- Messages

- 6,699

"Form 8948 must be filed by a tax return preparer by law to e-file any "covered" return that can be e-filed but chooses to paper file the return instead.

This is for retail preparers who file 11 or more returns."

I work for H&R Block this season and this is directly from their literature.

They are encouraging efile for many reasons.

I prepare my own taxes and do not use any paid preparer, so form 8948 is irrelevant to me.

rescueme

Thinks s/he gets paid by the post

Like your SS benefit (both forecast and actual payments)?can you imagine what the software would be like if the government created it? what a nightmare.

Yep, it would be as helpful and clear as the present IRS publications.can you imagine what the software would be like if the government created it? what a nightmare.

Rustward

Thinks s/he gets paid by the post

- Joined

- Apr 19, 2006

- Messages

- 1,684

If the IRS is collecting data in paperless fashion from all sources, it should be a simple matter for their computer to total my numbers, and send me a bill for whatever I owe. If there are certain non-reported elements, such as deductable expenses, I can file just that data. Now THAT's what I'd call paperless.

Not all sources. Most people would not be happy with this.

Texas Proud

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 16, 2005

- Messages

- 17,267

I don't think you can legally ride a horse to work, shopping, etc. any more - I am sure there would be penalties if you did. Though not legally required, not having a phone wouldn't exempt you from any number of tasks that require a phone, so access is virtually required.

I am all for the IRS or any government agency improving efficiency and reducing costs, now more important than ever with our deficits. Going paperless isn't "needlessly difficult" either IMHO, so we disagree, no problem...

I have seen people ride their horse to the store... where is it illegal

Similar threads

- Replies

- 5

- Views

- 1K

- Replies

- 39

- Views

- 2K

- Replies

- 6

- Views

- 1K