freebird5825

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

3/4 indexed funds

1/4 a potpourri of managed funds and individual stocks

1/4 a potpourri of managed funds and individual stocks

Doesn't that imply a stock picker could have picked the best stocks of the S&P 500 and beat the S&P?...last year was the only exception when nothing but the s&p 500 was doing well.

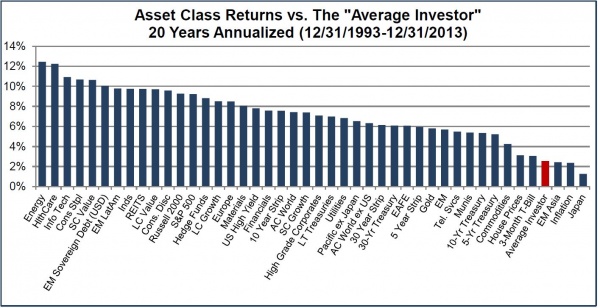

It means that even if you had left your money invested with a high fee asset

manager over this period you very likely beat the returns generated by most of

your peers even though most high fee asset managers fail to beat “the market” or

index funds.

+1We have index funds in our portfolio. We also have actively managed investments.