NameTaken2

Recycles dryer sheets

- Joined

- Jan 15, 2014

- Messages

- 182

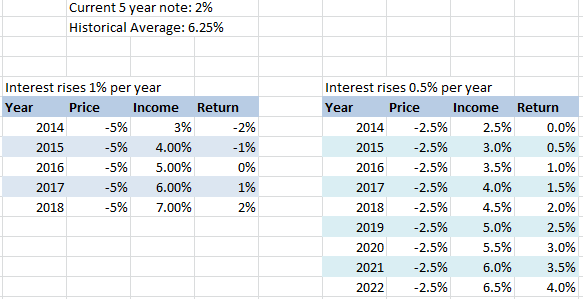

With rising rates leading many to seek alternatives to bonds, I’m trying to quantify the possible downside risk (reasonable range and worst-case) over the next 3-5 years for a new investment in Vanguard Total Bond Index VBMFX.

The following Morningstar article states "Bonds are very predictable. Over the next 3-5 years, returns are going to be close to the starting yield" and supports this with Exhibit 2.

http://news.morningstar.com/articlenet/ ... 00#cpage=3.

Using this predictor, Total Bond Market Index VBMFX should have an annual rate of return just below 3% over the next 3-5 years. (=10 year treasury rate)

As of 12/31/13 the VBMFX 1yr return was –2.26%, 3yr=3%, 5yr=4.3%.

This is very interesting -I won't pretend to understand this predictor, but if reliable then the -2.26% return requires positive returns the next 2-4yr to provide a 3% rate of return. I was under the impression that rising rates mean more negative returns for VBMFX the next 3-5 years, and therefore considering the strategy used by many of placing 50% of my bond allocation in a Stable Value fund with a 2.1% yld.

If this predictor can be trusted then this fear seems unwarranted, and maybe the SV fund isn't a slam-dunk strategy? A 3% annual return for VBMFX for the next 3-5yr isn't nearly as bad as I thought it could be. I must be missing something(?)

I’m a new retiree working on allocating a lump sum and 401k, and need an understanding of the potential downside risk for VBMFX over the next 3-5yr before implementing a strategy to avoid it. Nobody can predict the future but recommendations to seek alternatives to bonds must have some basis on an expected range for losses in total bond funds over the next 3-5years(?)

Thanks-

Surfin

The following Morningstar article states "Bonds are very predictable. Over the next 3-5 years, returns are going to be close to the starting yield" and supports this with Exhibit 2.

http://news.morningstar.com/articlenet/ ... 00#cpage=3.

Using this predictor, Total Bond Market Index VBMFX should have an annual rate of return just below 3% over the next 3-5 years. (=10 year treasury rate)

As of 12/31/13 the VBMFX 1yr return was –2.26%, 3yr=3%, 5yr=4.3%.

This is very interesting -I won't pretend to understand this predictor, but if reliable then the -2.26% return requires positive returns the next 2-4yr to provide a 3% rate of return. I was under the impression that rising rates mean more negative returns for VBMFX the next 3-5 years, and therefore considering the strategy used by many of placing 50% of my bond allocation in a Stable Value fund with a 2.1% yld.

If this predictor can be trusted then this fear seems unwarranted, and maybe the SV fund isn't a slam-dunk strategy? A 3% annual return for VBMFX for the next 3-5yr isn't nearly as bad as I thought it could be. I must be missing something(?)

I’m a new retiree working on allocating a lump sum and 401k, and need an understanding of the potential downside risk for VBMFX over the next 3-5yr before implementing a strategy to avoid it. Nobody can predict the future but recommendations to seek alternatives to bonds must have some basis on an expected range for losses in total bond funds over the next 3-5years(?)

Thanks-

Surfin