brewer12345

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 6, 2003

- Messages

- 18,085

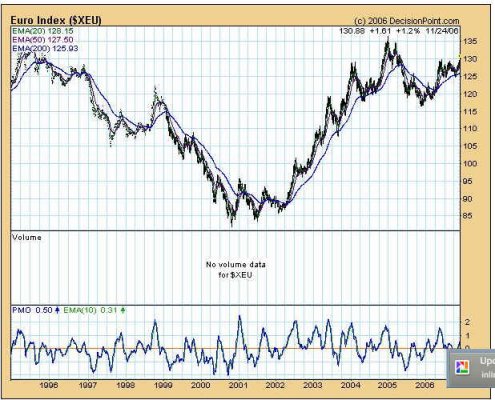

Nobody noticed the USD gapping down on Friday? My commodities and foreign bond funds when ape-poopy while I was busy stuffing myself taking DD to a children's museum...