audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

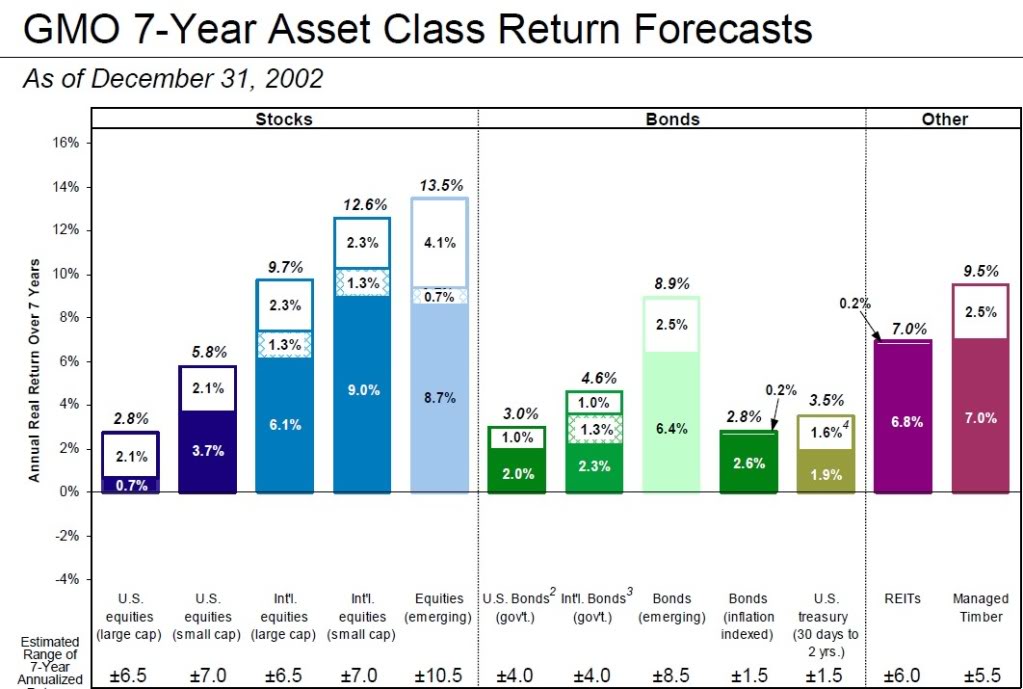

In equities in addition to US large cap, I have US Mid-cap and Small-cap, plus foreign large-cap and mid-cap, and a big chunk of REITS. In bonds, I have several diversified intermediate bond funds that have a lot of corporate debt, GNMA fund and municiple bond fund, plus a multi sector bond fund that has foreign debt, emerging market debt barbelled with treasuries/TIPs (FSICX).Audrey, I'm curious what you are then favoring? I promise not to critique your choices and if you prefer not to discuss this, just ignore this question.

Regarding the above assets classes: When I look at my portfolio I do have some exposure to intermediate govt though Pimco is underweight US Treasury, and overweight TIPS + foreign (see M*). My total bond market has a good size chunk of US intermed Treasury. Also I own a large chunk of large-cap US value index.