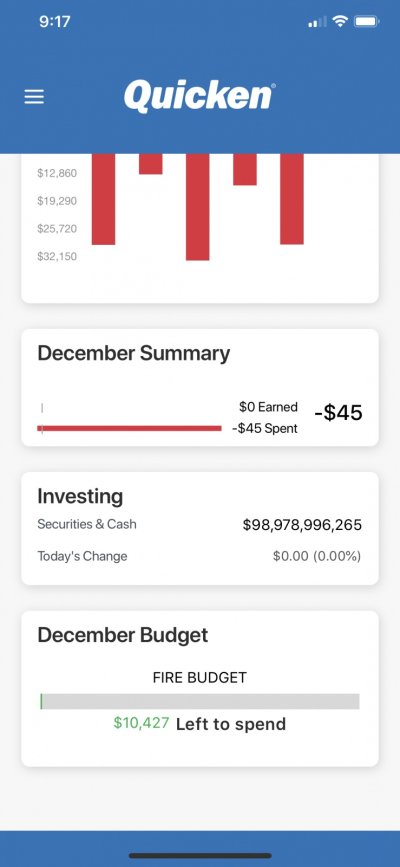

While most of my investments are with Vanguard, I also have Fidelity HSA, an online savings account, a whole-life policy and a tIRA bank CD.... and I want to look at my actual AA vs my target AA across all those accounts combined and to my knowledge, neither Vanguard nor Fidelity are set up to do that. I track all of these in Quicken (most transactions are uploaded when I do a One-Step Update for me to review and accept)... run a Portfolio Value by Account report... copy and paste it into a worksheet in Excel and then another worksheet draws drom that data and does a comprehensive analysis of actual AA vs target AA. Yet another sheet calculates YTD return and a couple other metrics.

With Excel, I can also categorize money as I want for AA purposes. For example, I have a small preferred stock portfolio that is about 8% of my portfolio that I consider as a bond equivalent... Fidelity considers it to be a stock. Another example would be I have some money temporarily parked in VMMXX earning 2.47%, the same as a 2-year CD.... waiting for a place to go that I view as a bond-equivalent rather than cash, so I can reflect that nuance in my AA vs target.