davismills

Recycles dryer sheets

- Joined

- Dec 6, 2012

- Messages

- 335

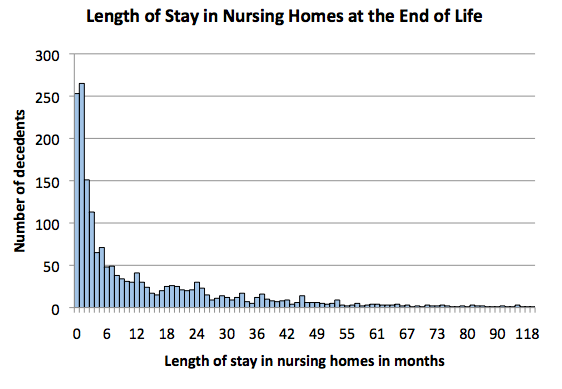

If you're caring for aging parents, I'd suggest an elder lawyer. I waited too long for my Mom and she was just 30K away from medicaid when she passed. I must say that her care was excellent. The costs were high because of her Alzheimer's affliction. She was in these facilities for over 7 years.