IndependentlyPoor

Thinks s/he gets paid by the post

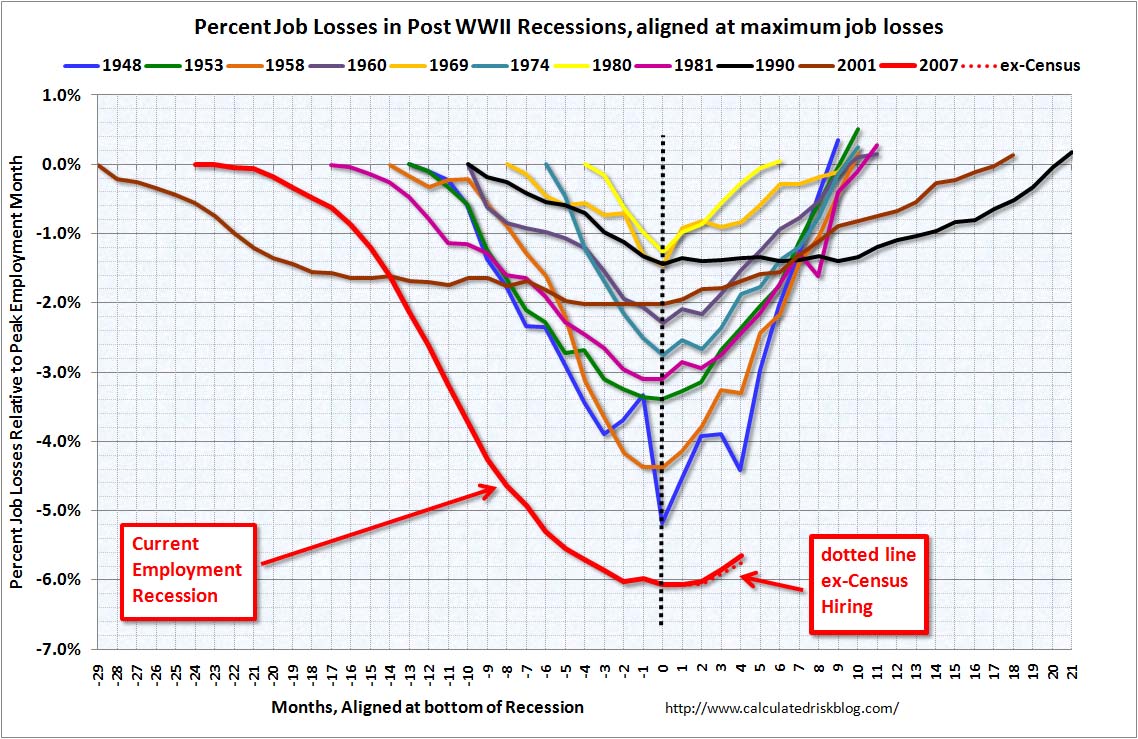

Must have been, but when was that?Wasn't the jobless stats helped by the 48000 census takers?

Must have been, but when was that?Wasn't the jobless stats helped by the 48000 census takers?

The last two sets of results.Must have been, but when was that?

Altucher is an unusually useless pundit, in a generally useless field. His comment implying that 1982 was worse than the present from an investor's viewpoint shows extreme misunderstanding of finance. Then we had 15% long term treasury rates, and an extremely depressed stock market. Times were bad, right? No doubt about it, they were. But the S&P sold at a PE10 of about 7 versus today's 20+. And long term governments would return $15,000 or so on a $100,000 investment. Contrast either of those metrics with today's. The situation was was serious. Whether it was worse than today IMO is highly debatable. What is not debatable is that then we were well paid to run those risks, and today we eat grass.

Sorry to bump an old thread, but looky what I found...Wasn't the jobless stats helped by the 48000 census takers?

The other strange thing is I have never seen so many people driving cars. I think every family here has one per person. How are they doing it is beyond me. Old trig

One thing for sure - it isn't mass transportation.I think it may be a mass psychosis.

What do we mean by "liquidity rallies?" There is a certain amount of economic foundation to this market action. The government pumps money into the "system" and it finds its way to Wall Street in order to leverage speculation for quick profits.

As the stock market rallies, it appears to many observers that the market is predicting a grandiose upswing in the economy. As it turns out, though, the speculative fervor generated by easy money only makes stock prices go higher -- it does not fix the economic woes. Once the economic data refuses to improve, the market realizes that it has overshot on the upside and another, usually slower, bear market unfolds.

The liquidity rally of 2009-2010 extended farther than we thought it would, eventually rising more than 80% off the March 2009 lows.

You know what is funny. I had bought my Dads business in 1980. I went through 1982 never knowing anything about how the economy was doing. It is different today I can assure you. In 1982 there were jobs. The city I live in has lost 9000 jobs since 1998. They will never return. Textile jobs. These jobs were held mostly by hard working uneducated people. I do not know how others are doing in the US but here it is not good. The other strange thing is I have never seen so many people driving cars. I think every family here has one per person. How are they doing it is beyond me. Old trig

Good news for a change?

Calculated Risk: Chicago Fed: Economic Activity increased in May

Even the consumer spending might be skewed. In my world here, families are moving in together and the kids have extra money all of a sudden and they love to spend it.

Interesting to read about what people are observing in their own corner of the world. From what I have read, I would imagine economic impacts are particularly drastic where you are, in California (as revealed in your profile).

Even as the "recovery" was underway, it was obvious by looking at state and local governments that another shoe was going to drop because the private sector rebound just couldn't be strong enough to avoid that. Whether it was layoffs, pay cuts or benefit cuts or whether it was higher taxes, there were no options that weren't going to create a tougher economic climate.In my corner of the world, I think that we are starting to feel the second dip. Government workers and contractors have started to be laid off in large numbers and the housing market seems to have slowed down again.

Even as the "recovery" was underway, it was obvious by looking at state and local governments that another shoe was going to drop because the private sector rebound just couldn't be strong enough to avoid that. Whether it was layoffs, pay cuts or benefit cuts or whether it was higher taxes, there were no options that weren't going to create a tougher economic climate.

The day of reckoning for state and local government budgets appears to be here. The can can't be kicked down the road any more. No options are anything but very unpleasant.

That is one real bummer of a reality check. Many of us in private industry have long known we have to keep our skill sets relevant and our resume up to date at all times. I'll bet some of these folks never bothered to do so because of the different culture that led them to think the job was there as long they wanted to keep it -- and they fully intended to retire there. Now they are sucker punched in the gut and I'll bet a lot of them are ill-prepared.They interviewed some of those laid-off government workers on local TV the other day, and those people were dejected. They kept saying "we thought we had job security, you know". Some of those people worked for the Federal government too (NASA I think).

Lakshman Achuthan points out that we have already had a longer expansion since the end of the recession than we had between the 1980, 1982 double dip.

Audrey