king smoothie

Dryer sheet aficionado

- Joined

- May 9, 2016

- Messages

- 42

Hi, I have been reading the forums on this site regularly for over a month now. I am 45 years old, I retired from the Navy after 20 years of service (at 38 years of age). I considered myself semi-retired for 5 years, staying home to care for our 5th child when she was born. I am now working full-time to boost our savings and to help pay for family vacations- getting off of Guam can be expensive. I have found that I like being semi-retired better than working full time.

My DW is an active-duty Navy Nurse and intends on serving for another 7 years, but she can retire in 2 years if she chose to do so. If she goes the 7, we expect a total combined pension income of $70,000 to $80,000 in today's dollars, depending on advancement. We have retirement funds in TSP (mix of traditional and Roth) and in roth IRAs, but we don't plan on touching them until I am past 60, maybe much later. Also, we have some other savings and investments. We will have one house paid for in 7 years and maybe another depending on how much I work over those 7 years or how frugal we are. With no mortgage payment, the pension will put us pretty much where we want to be, although the back up plan will be to take 72T distributions (rolling TSP into an IRA or two) and some rental income. We will still have one child in middle school at that time and one child in college, if he so chooses. Much of what we have committed to provide for college funds is already invested in 529s, with a plan to top that off.

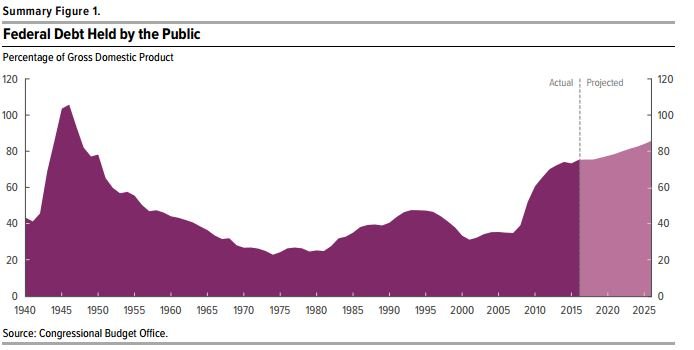

Not to come off as a nut job, but I am a bit concerned over something I have little control over and I wonder if anyone does anything to mitigate the risk of the federal government overextending itself and needing to limit pension obligations, print money and cause excessive inflation, and increase taxes. I figure owning property outright, having a big buffer or safety margin, and having multiple income streams seems to be about all you can do that is legal and reasonable.

My DW is an active-duty Navy Nurse and intends on serving for another 7 years, but she can retire in 2 years if she chose to do so. If she goes the 7, we expect a total combined pension income of $70,000 to $80,000 in today's dollars, depending on advancement. We have retirement funds in TSP (mix of traditional and Roth) and in roth IRAs, but we don't plan on touching them until I am past 60, maybe much later. Also, we have some other savings and investments. We will have one house paid for in 7 years and maybe another depending on how much I work over those 7 years or how frugal we are. With no mortgage payment, the pension will put us pretty much where we want to be, although the back up plan will be to take 72T distributions (rolling TSP into an IRA or two) and some rental income. We will still have one child in middle school at that time and one child in college, if he so chooses. Much of what we have committed to provide for college funds is already invested in 529s, with a plan to top that off.

Not to come off as a nut job, but I am a bit concerned over something I have little control over and I wonder if anyone does anything to mitigate the risk of the federal government overextending itself and needing to limit pension obligations, print money and cause excessive inflation, and increase taxes. I figure owning property outright, having a big buffer or safety margin, and having multiple income streams seems to be about all you can do that is legal and reasonable.