I can understand those who retire young and choose a withdrawal rate <4%.

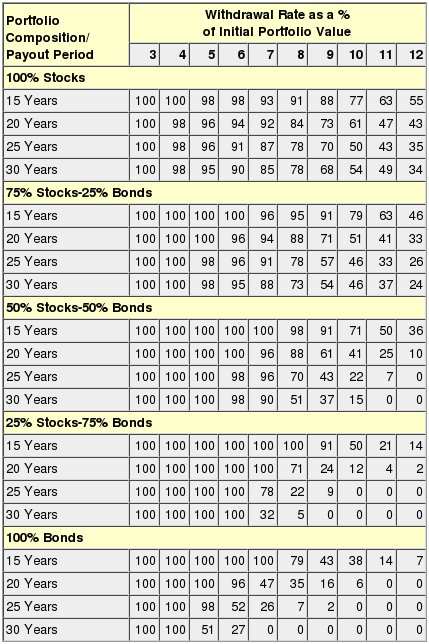

In the grand scheme of things, when is it prudent to pursue a withdrawal rate >4% and even much higher?

I wonder if on cruise ships very old people take the cruise because it's something they really want to do, or that they have so much money left, might as well spend it on something.

IOW, could we be delaying gratification too long, for a supposedly secure (100% safe) retirement?

Does anyone know someone who saved a lot, delayed gratification, only to pass it onto heirs who spend it frivolously?

In the grand scheme of things, when is it prudent to pursue a withdrawal rate >4% and even much higher?

I wonder if on cruise ships very old people take the cruise because it's something they really want to do, or that they have so much money left, might as well spend it on something.

IOW, could we be delaying gratification too long, for a supposedly secure (100% safe) retirement?

Does anyone know someone who saved a lot, delayed gratification, only to pass it onto heirs who spend it frivolously?