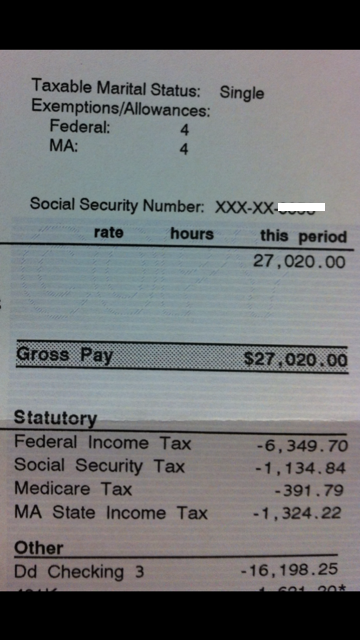

I'm reluctant to post this however I understand why my post seems out of the norm. I agree I do make a lot for my age and I do not take it for granted. I feel their is a lot to be learned on this forum but if I am going to contribute one day then I need to have some credibility. I hope after I post this we can get back to the topic at hand. I have already heard some good ideas. I have even thought about seeing a therapist in the past for my issue with spending on vehicles, that was great advice. What I attached is a monthly check I received a couple days ago, I get paid my actual check the 15th of each month and also get $1,000 a week.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

26 y/o with 350k income and impulse spending needs help

- Thread starter MDC86

- Start date

I started making good money as a young man (pharma sales). Not the kind of money you are talking about tho....

I started saving right away - even selling my personal vehicle and using the company vehicle to save on insurance and gas etc. The main motivator for me was fear. Turn over in the industry was high and if your numbers went south you were gone. I saved early on because I was afraid I would be looking for a job - it became a habit and I enjoyed investing and watching the balence grow. Got lucky, was good at my job and was promoted stayed for over 20 years - the biggest luck was having enough money when I had had enough of the BS and could jump ship. I remember my Dad saying "debt is good for a young man"! I think fear is!

I started saving right away - even selling my personal vehicle and using the company vehicle to save on insurance and gas etc. The main motivator for me was fear. Turn over in the industry was high and if your numbers went south you were gone. I saved early on because I was afraid I would be looking for a job - it became a habit and I enjoyed investing and watching the balence grow. Got lucky, was good at my job and was promoted stayed for over 20 years - the biggest luck was having enough money when I had had enough of the BS and could jump ship. I remember my Dad saying "debt is good for a young man"! I think fear is!

I can relate somewhat, since I own four Ferraris myself (as seen below).

However, I enjoy collecting them enough that I've never sold one.

I would advise asking yourself why you feel it necessary to go through your cars so quickly.

However, I enjoy collecting them enough that I've never sold one.

I would advise asking yourself why you feel it necessary to go through your cars so quickly.

LakeTravis

Recycles dryer sheets

I'm reluctant to post this however I understand why my post seems out of the norm. I agree I do make a lot for my age and I do not take it for granted. I feel their is a lot to be learned on this forum but if I am going to contribute one day then I need to have some credibility. I hope after I post this we can get back to the topic at hand. I have already heard some good ideas. I have even thought about seeing a therapist in the past for my issue with spending on vehicles, that was great advice. What I attached is a monthly check I received a couple days ago, I get paid my actual check the 15th of each month and also get $1,000 a week.

Sorry, I'm still skeptical. The right column of that ADP paystub (which is not in the image) would show YTD. And of course, for the first check of this year both columns would be the same.

I could tell you that I make $360K a year and show you that portion of my ADP payroll bonus check stub from last year ($30K) but it does not confirm that I was paid that every pay period.

check6

Recycles dryer sheets

- Joined

- Jan 7, 2009

- Messages

- 471

I owned a couple of Corvettes in my early thirties and motorcyles later. I now drive a 18 yr old pickup; no desire for a sports car and my last cycle has been collecting dust.

I owned an aerobatic plane in my late thirties/forties. No longer have an overwhelming desire for one.

Your wants will change as you age. Enjoy your toys while you are young. You will have lasting memories.

I owned an aerobatic plane in my late thirties/forties. No longer have an overwhelming desire for one.

Your wants will change as you age. Enjoy your toys while you are young. You will have lasting memories.

Sorry, I'm still skeptical. The right column of that ADP paystub (which is not in the image) would show YTD. And of course, for the first check of this year both columns would be the same.

Do Fortune 500s use ADP for payroll?

In any case, the OP needs to know how much they're spending. It looks like, at the OP's spending+savings rate, he/she won't be retiring for a good, long, time.

Edit: Using a salary calculator, the take home is about $190000. Minus the reported savings yields about $70,000 in spendable cash. If the OP is really spending only $70,000 and saving $120,000 then no problem.

Last edited:

if anyone has the brains, drive, skills, and experience to talk themselves into a finance position at a Fortune 500 company at such an age and to remain in that position for any length of time, they certainly do not need to be asking this forum for advice..

Very good point! While I understand my business quite well, I find that spending your own money on material things is quite different. Their is emotion involved while with the company it is pure logic, no emotion. I guess what I am trying to get out of this site of how does everyone not spend the money they are saving, especially when that number starts to really grow into the 6 and 7 figures and all of a sudden $5k or $50k doesn't seem like a ton anymore.

As far as everyone not believing me, I completely respect that. I learned a long time ago that if you have nothing nice to say then don't say it at all, so please have some respect. If you don't believe my postion and situation that is completly ok by me, but kinkly choose to not hit the reply button. I am not looking for attention here nor do I think this thread would turn into what it has at a place like this. Let's please get back to topic or let the thread die seeing how I was only trying to introduce myself. Thanks!

Gotadimple

Thinks s/he gets paid by the post

- Joined

- Feb 17, 2007

- Messages

- 2,618

While this sounds like bragging I am just trying to make a point that I have a interest in something and because I have the means for it to be funded, well its been spiraling out of control.

I know my car buying problem is hindering my ability to retire at a very young age. Cheers!

So let's get back to the original question. There are two points you make:

You have an expensive hobby - driving luxury cars

You want to retire early

Posters have given you lots of suggestions regarding your finances. But these are not financial questions you are asking - they are lifestyle questions.

You have an expensive hobby. If you feel the hobby is taking over your life, use your resources to get help in understanding what motivates you to invest in the hobby. Besides driving these cars, what do you do with them?

You need to ask yourself what you want from your money. You can do a lot with it besides buy two luxury cars a year. What other things can you do with this resource that will give you pleasure (not just the pleasure of owning a thing). Given your experience and your resources there are plenty of non-profits who would give anything to have you on their board of directors. Assuming that is the way you want to spend your time and believe in their mission enough to donate to the cause.

You need to consider what you want from your life, because retiring early without considering that question will result in an unhappy life.

I commend you for your early success in your career. I hope you find answers to your lifestyle questions. Others can suggest what you should do, but ultimately you have to ask yourself what you want from your life.

-- Rita

Very good point! While I understand my business quite well, I find that spending your own money on material things is quite different. Their is emotion involved while with the company it is pure logic, no emotion. I guess what I am trying to get out of this site of how does everyone not spend the money they are saving, especially when that number starts to really grow into the 6 and 7 figures and all of a sudden $5k or $50k doesn't seem like a ton anymore.

I think most people here who have a 7-figure portfolio would think that $5K or $50K is a ton of money. Say you have a $2M portfolio. In this low yield environment, this kind of portfolio can only support about $60K in spending per year if you don't want to eat into your principal. So blowing $50K or even $5K is a big deal. You certainly can't afford to buy Ferraris every other year on this kind of budget.

One suggestion on the car front, is to get one good car as your daily driver (like the audi), and then just rent the "fun" cars when you're looking for some excitement. My hubby's boss does this, and it allows him to check out a lot of different cars, without the ownership and depreciation costs. It's still an expensive hobby, but at least it's more easily controlled.

Welcome to the board!

Welcome to the board!

Do fortune 500 companies use ADP?

Yep - I work for a fortune 500 company, and payroll is adp.

As far as salary - I have a family member who graduated top of his class from Wharton and was making about $300k 2 years out of college. But he was working on Wall Street. He switched careers (to one less lucrative, but much more satisfying) and now makes less than half what he did back then. His choice... but he's happy.

I also know the CFO at our company (which was fortune 500 and acquired by a fortune 50) had a base salary of around $375k before bonuses and stock. But he was in his mid-40's. I think he's retired now since he had a *very* nice parachute associated with the buy out. Directors were no where near his pay.... he was a c-exec and had to sign off on the quarterly statements.

Yep - I work for a fortune 500 company, and payroll is adp.

As far as salary - I have a family member who graduated top of his class from Wharton and was making about $300k 2 years out of college. But he was working on Wall Street. He switched careers (to one less lucrative, but much more satisfying) and now makes less than half what he did back then. His choice... but he's happy.

I also know the CFO at our company (which was fortune 500 and acquired by a fortune 50) had a base salary of around $375k before bonuses and stock. But he was in his mid-40's. I think he's retired now since he had a *very* nice parachute associated with the buy out. Directors were no where near his pay.... he was a c-exec and had to sign off on the quarterly statements.

ok, maybe I am just jealous, but I am calling bs on this story (even with the pictures). I mean who in their right mind would give a 25 year old a 350k job in corporate America? Am I the only one who is doubting this? Usually when something is to good to be true, it is. So where is the catch?

Certainly not where I work. I work in the Finance Dept for one of the largest well known multinational corporation and under no circumstance will a 25 year old no matter how smart could become a Finance Director. My goodness, first you have to thorougly learn the business by moving around several Finance Dept - Operations, Marketing and Sales Finance, Accounting and Reporting, etc, etc.

Might be BS, but I've seen salespeople at my company earning that kind of money or better in their late-20s. Some of the sales VPs in their mid-30s are earning close to 7-figures.

Sales, possibly. Finance, definitely not.

You have to admit this situation is not the usual thing around here.As far as everyone not believing me, I completely respect that. I learned a long time ago that if you have nothing nice to say then don't say it at all, so please have some respect. If you don't believe my postion and situation that is completly ok by me, but kinkly choose to not hit the reply button. I am not looking for attention here nor do I think this thread would turn into what it has at a place like this. Let's please get back to topic or let the thread die seeing how I was only trying to introduce myself. Thanks!

Getting back to your questions, I would ask how regular is your income. That is, what % is base salary paid every 2 weeks and what % is at risk, variable or bonus, and may not be paid.

Very good point! While I understand my business quite well, I find that spending your own money on material things is quite different. Their is emotion involved while with the company it is pure logic, no emotion. I guess what I am trying to get out of this site of how does everyone not spend the money they are saving, especially when that number starts to really grow into the 6 and 7 figures and all of a sudden $5k or $50k doesn't seem like a ton anymore.

As far as everyone not believing me, I completely respect that. I learned a long time ago that if you have nothing nice to say then don't say it at all, so please have some respect. If you don't believe my postion and situation that is completly ok by me, but kinkly choose to not hit the reply button. I am not looking for attention here nor do I think this thread would turn into what it has at a place like this. Let's please get back to topic or let the thread die seeing how I was only trying to introduce myself. Thanks!

Guess, grammar and proper writing skills are not required to be a Finance Director at your mega corp.

marko

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 16, 2011

- Messages

- 8,505

Might be BS, but I've seen salespeople at my company earning that kind of money or better in their late-20s. Some of the sales VPs in their mid-30s are earning close to 7-figures.

I agree. It's industry dependent, but my old co paid very high 6 figures to a lot of sales and VPs.... many were in their early 30's.

A lot depends on where you live too. $350K in Manhattan?...living wage.

frayne

Thinks s/he gets paid by the post

MDC, what is your education background ? Being in finance I would think you would have a much better handle own your personal finances. Also seems like you might consider a personal advisor as opposed to seeking help on this type of a board.

ShortInSeattle

Full time employment: Posting here.

- Joined

- Jan 5, 2012

- Messages

- 518

Perhaps those who simply disbelieve the OP should just move on to the next thread?

(ducks and covers)

SIS

(ducks and covers)

SIS

frayne

Thinks s/he gets paid by the post

Guess, grammar and proper writing skills are not required to be a Finance Director at your mega corp.

Hear, their and everywhere ? I had the same thoughts as well.

Hostile reactions are not the usual character for this board. Maybe the OP is a fake, but his story is within the realm of possibility, so I just accept it at face value and move on. If he's a troll the story will become more outrageous, and then he'll leave. After a cold shoulder response, it would not surprise me if he chooses to leave even if he has been factual with us.

The rules for retirement are the same no matter how much you make. You have to spend less than you make. Save and invest the difference.

I would first figure out at what level of spending I would be comfortable retiring at. Generally accepted safe withdrawal rate is about 4% If you are younger than 55 or so you would want to take a bit less. So something like 25 to 30 times your annual spending would be how much you need.

Figure out how long it will take you to get there at your savings rate. Then figure how long it would take you if you quit buying cars.

How much is your time worth? If you want to get out early you need to save the max you can and live as modestly as you are comfortable. If you want to live higher and spend money on cars or other depreciating assets you are going to work longer.

Lastly maybe a walk in a junkyard would remind you of the fate of all new shiny cars. Then take a walk in a cemetery to see what your fate is.

Maybe time in the office to have those shiny things is worth it maybe its not. Only you can decide that for yourself.

I would first figure out at what level of spending I would be comfortable retiring at. Generally accepted safe withdrawal rate is about 4% If you are younger than 55 or so you would want to take a bit less. So something like 25 to 30 times your annual spending would be how much you need.

Figure out how long it will take you to get there at your savings rate. Then figure how long it would take you if you quit buying cars.

How much is your time worth? If you want to get out early you need to save the max you can and live as modestly as you are comfortable. If you want to live higher and spend money on cars or other depreciating assets you are going to work longer.

Lastly maybe a walk in a junkyard would remind you of the fate of all new shiny cars. Then take a walk in a cemetery to see what your fate is.

Maybe time in the office to have those shiny things is worth it maybe its not. Only you can decide that for yourself.

I suspect the cars are a way to tell everyone, "Yes, I am young but I AM somebody!". Or maybe not.

The savings rate and buying 1-2 $100k cars/year doesn't work, given your take home. If you look at your quarterly brokerage statement(s), does it really have $5-15k in deposits/month? You're spending way more than you think. Or maybe the cars are on lease?

The savings rate and buying 1-2 $100k cars/year doesn't work, given your take home. If you look at your quarterly brokerage statement(s), does it really have $5-15k in deposits/month? You're spending way more than you think. Or maybe the cars are on lease?

OP,

You must be a finance whiz to get that much money when you were just 21yo (maybe still in college or barely out of it). And then more than doubling that salary in 5 years. Your company must believe in your ability. Just apply that ability to your finances.

You must be a finance whiz to get that much money when you were just 21yo (maybe still in college or barely out of it). And then more than doubling that salary in 5 years. Your company must believe in your ability. Just apply that ability to your finances.

Bestwifeever

Moderator Emeritus

- Joined

- Sep 17, 2007

- Messages

- 17,774

I actually don't think there is a problem with someone at this income level owning an Audi and a Ferrari (or even trading them in every year for new models). If you really are enjoying them, great. If you are feeling a little sick about owning them, then you probably should think about getting rid of the Ferrari. It's like drinking alcohol--if you worry about how much you are drinking, then you know you have a problem.

Whatever you earn isn't the issue imo. If you are for real, I hope you're not posting from your office computer as the IT people are passing around your pay stub right now.

Whatever you earn isn't the issue imo. If you are for real, I hope you're not posting from your office computer as the IT people are passing around your pay stub right now.

Texas Proud

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 16, 2005

- Messages

- 17,369

Well, I say let the guy alone... who know how he got the job... or if he even has it, but he has posted items that others would not post to prove his point... in the end, it really does not matter...

To the OP... why do you feel you have to have a new car so often The 'new' does not wear off of me for about 3 years... I had a BIL who did a trade in every 2.. I assume that you are trading in the used cars instead of holding on to them....

The 'new' does not wear off of me for about 3 years... I had a BIL who did a trade in every 2.. I assume that you are trading in the used cars instead of holding on to them....

I think you are trying to prove to others that you 'have it made'... for some reason you need this validation... I would seriously look into why... it's not like a new car has any more utilization than a one year old car... and how many miles can you have on one anyhow

Good luck to you in your future... if you change your ways you will be FI very quickly and then can decide what

To the OP... why do you feel you have to have a new car so often

I think you are trying to prove to others that you 'have it made'... for some reason you need this validation... I would seriously look into why... it's not like a new car has any more utilization than a one year old car... and how many miles can you have on one anyhow

Good luck to you in your future... if you change your ways you will be FI very quickly and then can decide what

Similar threads

- Replies

- 56

- Views

- 3K