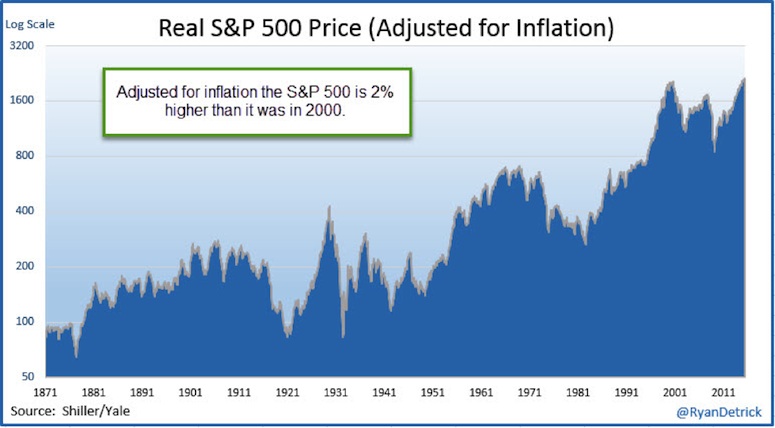

There are a few looooonnng peak-to-peak periods in there that are kindof scary. Heck, the 1999 crowd is just now getting back to pre-crash levels, adjusted for inflation.

Wow, that’s an entire generation of no real growth, but I don’t think that includes dividends, does it? Now I’m really curious.