ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Compare with Henry Heebler's simplified auto-pilot method.

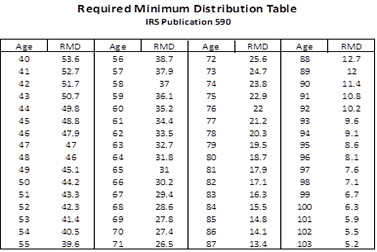

Interesting. It is basing WR on an average of the 4% 'rule' and the govt published RMDs.

If I'm following this right, the initial WR for a 65YO is the average of 1/31 and 4%. That is 3.23% and 4.00%, so average is 3.615%. And it dips considerably in his 1965 scenario, looks like ~ 2.5% at about 15 years in?

Compare to a FIRECalc run (not directly comparable - his conditions are slightly different, I might try to model both in FIRECalc later) which shows that a constant 3.58% survives.

But it's food for thought. I'm thinking it might look good for me by combining the RMD calc with a lower baseline WR, like 3.5%? And I've definitely thought about using RMD as part of the equation for my later years.

-ERD50