Latest US Average Life Expectancy At Birth Figures:

80.0 Years: Central Intelligence Agency (CIA).

78.6 Years: Centers for Disease Control and Prevention (CDC).

78.5 Years: Organization for Economic Co-operation and Development (OECD).

Both sexes: 76.4 years

Males: 73.5 years

Females: 79.3 years

Mortality in the United States, 2021 (Figure 1)

For men only it is much lower, however, depending what year you were born it can vary. Assuming average age at death is 76.1, someone 66 would have about 10 years, I am a bit older.

Conclusion; Rounding data maybe a good 20 years and another 5 crappy years at best, but more likey for me <20 or live to 89 maybe?

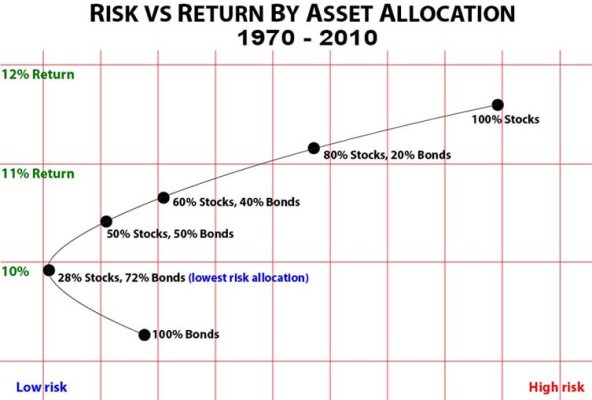

You are so correct the WD rate is fine, I meant to address only risk on equities versus other lower risk investments strictly over the next 10 to 20 years. Data for that chart spanned a much longer period I believe but there was no reference in that post. A conservative investment has low risk or guaranteed principle, and growth > inflation.

To me, using a 30 year data set for a 10 to 20 year comparison, is not a valid assumption without some statistical variant to adjust for the duration.

80.0 Years: Central Intelligence Agency (CIA).

78.6 Years: Centers for Disease Control and Prevention (CDC).

78.5 Years: Organization for Economic Co-operation and Development (OECD).

Both sexes: 76.4 years

Males: 73.5 years

Females: 79.3 years

Mortality in the United States, 2021 (Figure 1)

For men only it is much lower, however, depending what year you were born it can vary. Assuming average age at death is 76.1, someone 66 would have about 10 years, I am a bit older.

Conclusion; Rounding data maybe a good 20 years and another 5 crappy years at best, but more likey for me <20 or live to 89 maybe?

You are so correct the WD rate is fine, I meant to address only risk on equities versus other lower risk investments strictly over the next 10 to 20 years. Data for that chart spanned a much longer period I believe but there was no reference in that post. A conservative investment has low risk or guaranteed principle, and growth > inflation.

To me, using a 30 year data set for a 10 to 20 year comparison, is not a valid assumption without some statistical variant to adjust for the duration.

Last edited: