boilerman

Recycles dryer sheets

- Joined

- Sep 29, 2007

- Messages

- 155

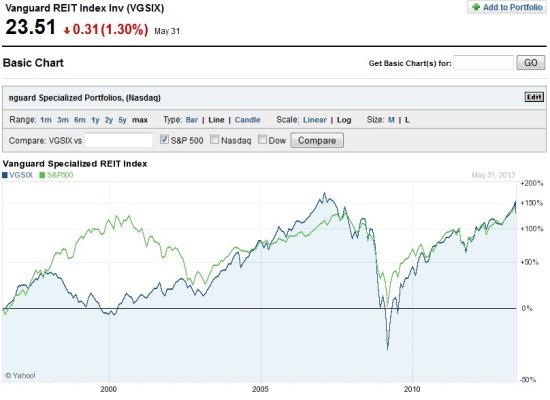

I've recently become interested in REITs for my 401k as a way of diversifying. Sites like Vanguard say that they provide diversification from stock market holdings and I have always been a fan of real estate. The problem is that when plotting the performance of REITs against the S&P 500, the REIT funds seem to behave similar to stocks.

For those who hold REITs, where do they fit into your asset allocation? Do you think REITs provide diversification from stocks?

For those who hold REITs, where do they fit into your asset allocation? Do you think REITs provide diversification from stocks?