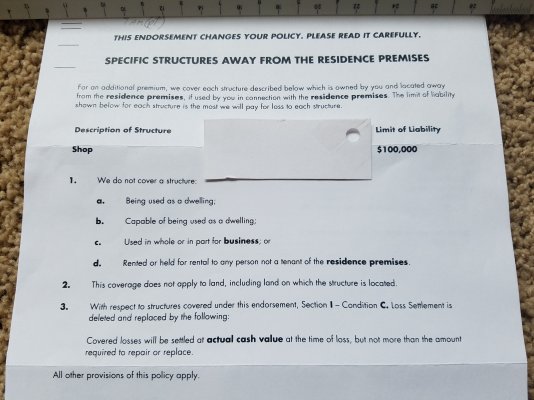

A year ago I bought a property with an old mobile home on it. I do not currently live on the*property and never have.* Last summer I built a large shop with a room attached to it for a home gym (with toilet and shower). This summer I intend to build a house on the same property. I have removed the old mobile and requested that my umbrella policy include this shop/home gym. My question regards the wording of the policy they sent me. There are 4 things listed that the policy says are not covered:

A- Being used as a dwelling

B-Capable of being used as a dwelling

C-Used in whole or part for business

D-Rented or held for rental to any person not a tenant of the residence premises.

I'm Okay with A, C and D but I am uncomfortable with "B". It looks like something that was put in there to allow the insurance*company a way to weasel out of paying a claim if they were so inclined. It seems like any structure could be used as a dwelling. I voiced my concern with my local agent and I could tell that she thought I was being "difficult".* If there is an insurance professional here, can you tell me if this is standard stuff or am I right to be uncomfortable*with this wording?

I'm thinking about shopping for another independent insurance agent (In addition to the umbrella coverage I have multiple houses, motorcycles and cars with the same agency).

Thanks, RDW

A- Being used as a dwelling

B-Capable of being used as a dwelling

C-Used in whole or part for business

D-Rented or held for rental to any person not a tenant of the residence premises.

I'm Okay with A, C and D but I am uncomfortable with "B". It looks like something that was put in there to allow the insurance*company a way to weasel out of paying a claim if they were so inclined. It seems like any structure could be used as a dwelling. I voiced my concern with my local agent and I could tell that she thought I was being "difficult".* If there is an insurance professional here, can you tell me if this is standard stuff or am I right to be uncomfortable*with this wording?

I'm thinking about shopping for another independent insurance agent (In addition to the umbrella coverage I have multiple houses, motorcycles and cars with the same agency).

Thanks, RDW