steelyman

Moderator Emeritus

This article appeared today (Jan 6, 2023) on CNBC. I know the topic is much discussed here so it may be of interest.

I have a Medicare Advantage (not Medigap, aka “Supplement”) policy through my former employer but don’t advocate either way around.

I have a Medicare Advantage (not Medigap, aka “Supplement”) policy through my former employer but don’t advocate either way around.

About 23% of Medicare’s 65.1 million beneficiaries are enrolled in a Medigap plan.

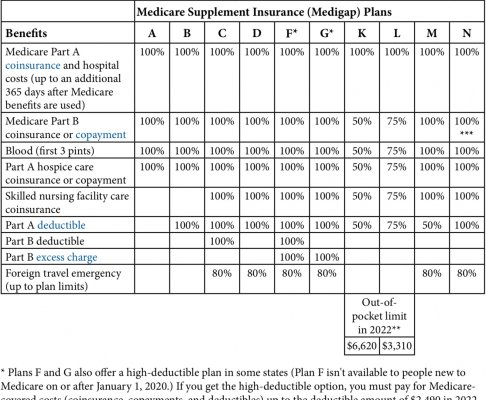

While these supplemental insurance policies either partially or fully cover cost-sharing associated with basic Medicare (Part A hospital coverage and Part B outpatient care), the monthly premiums can be pricey.

There are a variety of things that can contribute to the cost of premiums, both when you first sign up and over time.

Key things to know if you’re eyeing a Medigap policy alongside basic Medicare

https://www.cnbc.com/2023/01/06/key...yeing-medigap-policy-with-basic-medicare.html