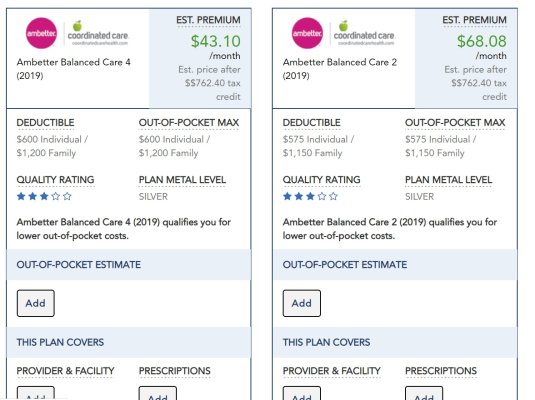

Health insurance is pretty cheap right now for lower income. A couple in their 40s is paying maybe $100 a month for a really good policy with a max out of pocket of $750 a year.

Once you knock that out of the equation and if you live in a lower cost of living area, then I am not sure you need a couple million to live a pretty comfy life. You only need 10 years for SS credits and one spouse doesn't need any at all. Someone who retires at 45 might have 25 years of SS credits and be eligible for $1500 to $2000 at full retirement age while their spouse would be eligible for $750 to $1000. That is $2250 to $3000 a month at age 67.

Say you retired at age 45 with $1,000,000 and were able to live on $40,000 a year in a low cost of living area. By most calculators you will still have nearly $1,000,000 at age 67 when SS will boost your annual income to $67,000 or more (inflation adjusted). Not so bad.

Once you knock that out of the equation and if you live in a lower cost of living area, then I am not sure you need a couple million to live a pretty comfy life. You only need 10 years for SS credits and one spouse doesn't need any at all. Someone who retires at 45 might have 25 years of SS credits and be eligible for $1500 to $2000 at full retirement age while their spouse would be eligible for $750 to $1000. That is $2250 to $3000 a month at age 67.

Say you retired at age 45 with $1,000,000 and were able to live on $40,000 a year in a low cost of living area. By most calculators you will still have nearly $1,000,000 at age 67 when SS will boost your annual income to $67,000 or more (inflation adjusted). Not so bad.