rocks911

Recycles dryer sheets

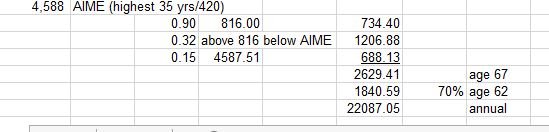

I have many years of paying into Social Security and certainly qualify for retirement benefits but that is many years down the road. What effect will years of zeros have on my benefits? In other words I will not be earning a paycheck and paying into SS for the next decade before age 65, I will be living off my company retirement and IRA's. Will years of not working reduce my benefits?