I am dealing with the one more year syndrome right now. I could retire right now, but if I wait just a little over one more year then I get a better deal on my retirement. It does seem that the closer it gets---the slower it goes. About 2 years ago I decided that I would stay for the better deal and the time just zipped by until now.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Golden Handcuffs - a tougher form of the "one more year" syndrome.

- Thread starter Grep

- Start date

If I died at my desk, I’d be dead, with no regrets left to be had. If I did find myself looking back on my life, I might feel some satisfaction about many of the struggles and successes I’ve had in my career. I’ve fulfilled the most important dreams that I had as a child. I’d also be sad at the heavy price I paid for that, but this is water under the bridge.

What I regret now, while I’m still alive, are the little deaths that occur day by day, and the gnawing knowledge that work contributes most of them. But it’s not all bad – some of it is pretty good, which almost makes it worse – if it was all bad, my decision would be easy.

Shawn, you sound like you are still in the “it’s pretty much all bad” camp. The fact that you are even counting the days and months until you can bail out before 50 is a pretty sure indication of that. (I have similar options, but I at least have no problems staying until 50 or beyond.)

I’ve also considered that a reasonable exit point is when my pension covers my basic expenses. For me that is not until 55 or so. For you it is quicker (i.e., 50, not even padded to 53, by your numbers) due to your much higher salary and pension. However, this is really just an arbitrary threshold and an unnecessary emotional security blanket given our savings vs. expenses. The pension's weak indexing to inflation is also irrelevant compared to those factors.

I especially don’t understand your desire to be able to save out of your pension. What would you be saving for – retirement?!? If you had goals that required spending that money, fine. If you are really looking for justification to stay an extra few years at your hated job, then do yourself a favor and buy a 40 ft sailboat and a home in Tuscany. Otherwise, do yourself a favor and recognize that with your savings and spending habits, you don’t have a need to “save” in retirement, especially at the cost of more years of work. You’ve already earned it and paid taxes on it, so pensions are meant to be spent and enjoyed!

What I regret now, while I’m still alive, are the little deaths that occur day by day, and the gnawing knowledge that work contributes most of them. But it’s not all bad – some of it is pretty good, which almost makes it worse – if it was all bad, my decision would be easy.

Shawn, you sound like you are still in the “it’s pretty much all bad” camp. The fact that you are even counting the days and months until you can bail out before 50 is a pretty sure indication of that. (I have similar options, but I at least have no problems staying until 50 or beyond.)

I’ve also considered that a reasonable exit point is when my pension covers my basic expenses. For me that is not until 55 or so. For you it is quicker (i.e., 50, not even padded to 53, by your numbers) due to your much higher salary and pension. However, this is really just an arbitrary threshold and an unnecessary emotional security blanket given our savings vs. expenses. The pension's weak indexing to inflation is also irrelevant compared to those factors.

I especially don’t understand your desire to be able to save out of your pension. What would you be saving for – retirement?!? If you had goals that required spending that money, fine. If you are really looking for justification to stay an extra few years at your hated job, then do yourself a favor and buy a 40 ft sailboat and a home in Tuscany. Otherwise, do yourself a favor and recognize that with your savings and spending habits, you don’t have a need to “save” in retirement, especially at the cost of more years of work. You’ve already earned it and paid taxes on it, so pensions are meant to be spent and enjoyed!

Milton

Thinks s/he gets paid by the post

- Joined

- Apr 18, 2007

- Messages

- 2,360

Given that your investment income currently covers your expenses, it seems like you are in exactly the same pre-retirement boat as Shawn. Both of you are apparently aiming at "an arbitrary threshold and an unnecessary emotional security blanket givenI’ve also considered that a reasonable exit point is when my pension covers my basic expenses. For me that is not until 55 or so....

I especially don’t understand your desire to be able to save out of your pension. What would you be saving for – retirement?!? If you had goals that required spending that money, fine. If you are really looking for justification to stay an extra few years at your hated job, then do yourself a favor and buy a 40 ft sailboat and a home in Tuscany. Otherwise, do yourself a favor and recognize that with your savings and spending habits, you don’t have a need to “save” in retirement, especially at the cost of more years of work.

Perhaps, rather than lecturing him, you should take your own advice.

Milton,

I am aware that I am FI at least at a basic level, and I stated that in my first post. I am also aware that I'm in the same boat with regard to potentially waiting for some arbitrary threshold, etc. It's a common and very human condition. It was not my intention to lecture. Thank you.

I am aware that I am FI at least at a basic level, and I stated that in my first post. I am also aware that I'm in the same boat with regard to potentially waiting for some arbitrary threshold, etc. It's a common and very human condition. It was not my intention to lecture. Thank you.

FinanceDude

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Aug 3, 2006

- Messages

- 12,483

I'll guess $1,600,000 in retirement, a 4% withdrawal would give you $64,000 a year. Add a $20,000 a year pension onto that, and you get $84,000 a year before taxes. So, you can retire quite easily,it seems.

The harder part is the pull between career and retirement. You could always write continue to do research and get published, you could co-author articles, you could ask to speak at the annual meeting for your specialty, etc. Heck, depending on your speciality, you could work overseas and get paid.

Lots of opportunities, what is your specialty??

The harder part is the pull between career and retirement. You could always write continue to do research and get published, you could co-author articles, you could ask to speak at the annual meeting for your specialty, etc. Heck, depending on your speciality, you could work overseas and get paid.

Lots of opportunities, what is your specialty??

FinanceDude

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Aug 3, 2006

- Messages

- 12,483

Milton,

I am aware that I am FI at least at a basic level, and I stated that in my first post. I am also aware that I'm in the same boat with regard to potentially waiting for some arbitrary threshold, etc. It's a common and very human condition. It was not my intention to lecture. Thank you.

You are a professor, it is a natural instinct to lecture.........

Yes, "lecturing" (hopefully in a helpful way) is a hazard of being a Professor that we all fall prey to from time to time.

One nice thing about retiring as a Professor is that one typically becomes "Professor Emeritus." This title typically comes with a bit of support (e.g., office space, etc.) so that a "retired" Professor can stay engaged in the life of the campus. I work at a research institution, and many Professors here would prefer to give up the teaching responsibilities but stay engaged in the world of research. However, after over 100 publications and who-knows how many conferences, I find it a bit of a treadmill that I'd vastly prefer to get paid for.

As for finances, I'm not sure 4% is safe over 40+ years (one can hope) looking forward. But at 3% of ~$2M plus $20k plus low-cost health insurance plus a paid-off house plus S.S., my basics plus a little extra should be well-covered.

One point I left out is that I have an extremely interesting project that is possibly coming up at work. It would involve some rather unique and thrilling exploration that would satisfy another childhood fantasy of mine. It's not a ride on the Space Shuttle, but it's close in a way. If this research is funded, there's no question that I would retire before another ~3 years, while I devoted a big chunk of effort to that goal.

One nice thing about retiring as a Professor is that one typically becomes "Professor Emeritus." This title typically comes with a bit of support (e.g., office space, etc.) so that a "retired" Professor can stay engaged in the life of the campus. I work at a research institution, and many Professors here would prefer to give up the teaching responsibilities but stay engaged in the world of research. However, after over 100 publications and who-knows how many conferences, I find it a bit of a treadmill that I'd vastly prefer to get paid for.

As for finances, I'm not sure 4% is safe over 40+ years (one can hope) looking forward. But at 3% of ~$2M plus $20k plus low-cost health insurance plus a paid-off house plus S.S., my basics plus a little extra should be well-covered.

One point I left out is that I have an extremely interesting project that is possibly coming up at work. It would involve some rather unique and thrilling exploration that would satisfy another childhood fantasy of mine. It's not a ride on the Space Shuttle, but it's close in a way. If this research is funded, there's no question that I would retire before another ~3 years, while I devoted a big chunk of effort to that goal.

MasterBlaster

Thinks s/he gets paid by the post

- Joined

- Jun 23, 2005

- Messages

- 4,391

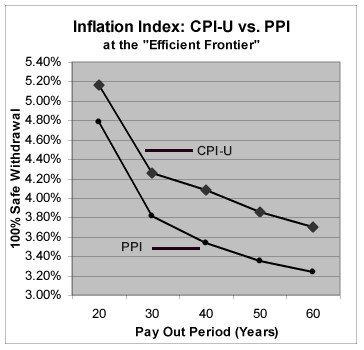

You can probably do a bit better than 3% SWR.

Here is Bernsteins chart on SWRs for various durations for a mixed stock-bond portfolio

Also, as you may know, if you take on somewhat more risk (ie a 99 or 95 percent safe withdrawal rate) the SWR goes up a percent or so.

Here is Bernsteins chart on SWRs for various durations for a mixed stock-bond portfolio

Also, as you may know, if you take on somewhat more risk (ie a 99 or 95 percent safe withdrawal rate) the SWR goes up a percent or so.

Attachments

MasterBlaster,

Can you please point to the article that this chart came from?

I think my portfolio is more conservative than most that that are used for these sorts of studies (40% diversified stocks, 20% bonds, 40% cash equivalents), but you are probably right that I could take more than 3%.

Can you please point to the article that this chart came from?

I think my portfolio is more conservative than most that that are used for these sorts of studies (40% diversified stocks, 20% bonds, 40% cash equivalents), but you are probably right that I could take more than 3%.

Grep, yes, my desire for early retirement is mainly driven by the fact that I do not like my job. While there are many things I'd like to do as an early retiree (e.g., adventure-type outdoor activities), I'm counting the days until I do not have to work as opposed to counting the days until I get to "have fun." As I've said before, the technical work is interesting, but the environment in which it is performed is horrendous. I suppose I could get a more pleasant job, but it would not come with the embedded rewards that I have now.

Waiting until lifetime medical at 50 seems like a prudent choice. It's a little bit of suffering for a fairly substantial reward. However, my thoughts of going to 53 (or 55 or 60) are not particularly rational. At 50, I'll have an effective (pension plus savings) withdrawal rate of about 1%. That's extremely safe and almost guarantees that my net worth will continue to grow at a fairly substantial rate. I tell myself that the extra money may someday be useful, but it seems unlikely that it will ever come in play. My personality is not to buy a $2M house. I have a blue collar outlook. An extravagant evening for me is bowling and dinner at Denny's (OK, I haven't done either in a long time, but hopefully the point is clear).

My desire to continue savings through my pension is also an emotional security blanket. Today, it feels good that my monthly salary pays my expenses and a lot more. It's a feeling of freedom, flexibility, and power. Financially, I continue to grow. Investments are variable, but the stability of the regular income feels good. Again, I acknowledge that this is not a rational feeling (i.e., my savings/investments will give me most of my income and growth). But it's a feeling nonetheless.

One reason I like reading this forum is to get the personal perspectives of other people about why and when they plan to or did retire. I find these types of threads quite interesting.

Waiting until lifetime medical at 50 seems like a prudent choice. It's a little bit of suffering for a fairly substantial reward. However, my thoughts of going to 53 (or 55 or 60) are not particularly rational. At 50, I'll have an effective (pension plus savings) withdrawal rate of about 1%. That's extremely safe and almost guarantees that my net worth will continue to grow at a fairly substantial rate. I tell myself that the extra money may someday be useful, but it seems unlikely that it will ever come in play. My personality is not to buy a $2M house. I have a blue collar outlook. An extravagant evening for me is bowling and dinner at Denny's (OK, I haven't done either in a long time, but hopefully the point is clear).

My desire to continue savings through my pension is also an emotional security blanket. Today, it feels good that my monthly salary pays my expenses and a lot more. It's a feeling of freedom, flexibility, and power. Financially, I continue to grow. Investments are variable, but the stability of the regular income feels good. Again, I acknowledge that this is not a rational feeling (i.e., my savings/investments will give me most of my income and growth). But it's a feeling nonetheless.

One reason I like reading this forum is to get the personal perspectives of other people about why and when they plan to or did retire. I find these types of threads quite interesting.

MasterBlaster

Thinks s/he gets paid by the post

- Joined

- Jun 23, 2005

- Messages

- 4,391

MasterBlaster,

Can you please point to the article that this chart came from?

Bernstein has written a number of articles. I can't remember which article that graph (that I kept) was part of.

His website is here:

Efficient Frontier

His book (The Four Pillars of Investing) is highly recommended on this forum

His articles on the retirement calculator from hell are very enlightening (in 4 parts)

http://www.efficientfrontier.com/ef/998/hell.htm

http://www.efficientfrontier.com/ef/101/hell101.htm

http://www.efficientfrontier.com/ef/901/hell3.htm

http://www.efficientfrontier.com/ef/103/hell4.htm

Bernstein is an achedemic specializing in Modern Portfolio Theory.

haha

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

One reason I like reading this forum is to get the personal perspectives of other people about why and when they plan to or did retire. I find these types of threads quite interesting.

Certainly my reason was not to have more fun. I never found work incompatible with having fun. I went about having some fun most of the time. My reason was that my work was a rael pain for me. It likely would not have been for another person, I think at least part of the problem was my attitudes.

If one is truly over the fence as you are, you can't really hurt yourself with any decision. Your "realistic" attitudes toward the fair sex should protect you from any fiscal hazards from that quarter.

Ha

REWahoo

Give me a museum and I'll fill it. (Picasso) Give

Looks like even Bernstein is on the bacon bandwagon. From the introduction to The Retirement Calculator from Hell:

"It turns out that if you have rotten returns in the first decade you will run out of money long before reversion to the mean saves your bacon in later years."

Yep. All bacon, all the time.

"It turns out that if you have rotten returns in the first decade you will run out of money long before reversion to the mean saves your bacon in later years."

Yep. All bacon, all the time.

Shawn,

You should definitely stick it out until you obtain low-cost medical insurance for life. That's a huge benefit, and it will be yours in a matter of months.

I'd speculate that your conservative stance is partly a response to the stress you feel at your job. In the run-up to tenure, which was exceedingly stressful, I felt much the same: a very strong need to accumulate savings and a need to maintain an almost absurdly-conservative financial stance that I've only recently relaxed.

However, I never quite felt dependency on the steady salary (in recent years), perhaps because it's not a very dominant source of my income at this point. But your salary is so good that it may be harder to imagine doing without.

If any of the above is true, you will likely be able to relax your outlook after a bit of time in retirement, as you see that you are not just surviving, but thriving.

Perhaps you could also benefit from some mental trick, maybe a form of a "mental buckets" approach in which at least one bucket is forcibly liberated from conservative financial paralysis. So, Mental Bucket 1 - your pension: Liberate yourself! Spend it on Denny's and bowling. Spend the 10k or more that's left over on some adventure travel or on friends and charity. Remember that the pension is on top of the 3 to 4%, or whatever you choose as an appropriate SWR, of savings and other income that you can spend. If you saved any of it, your "SWR" would be negative! Mental Bucket 2 - investment income: Dip into it for an occasional bigger adventure that especially excites you (Everest?), and use the rest to satisfy your emotional need to save and reinvest to supplement long-term growth. Bucket 3 - Any capital on top of the income: tucked away for your considered use when you realize that, yes, you have plenty and always will. Just an idea.

You should definitely stick it out until you obtain low-cost medical insurance for life. That's a huge benefit, and it will be yours in a matter of months.

I'd speculate that your conservative stance is partly a response to the stress you feel at your job. In the run-up to tenure, which was exceedingly stressful, I felt much the same: a very strong need to accumulate savings and a need to maintain an almost absurdly-conservative financial stance that I've only recently relaxed.

However, I never quite felt dependency on the steady salary (in recent years), perhaps because it's not a very dominant source of my income at this point. But your salary is so good that it may be harder to imagine doing without.

If any of the above is true, you will likely be able to relax your outlook after a bit of time in retirement, as you see that you are not just surviving, but thriving.

Perhaps you could also benefit from some mental trick, maybe a form of a "mental buckets" approach in which at least one bucket is forcibly liberated from conservative financial paralysis. So, Mental Bucket 1 - your pension: Liberate yourself! Spend it on Denny's and bowling. Spend the 10k or more that's left over on some adventure travel or on friends and charity. Remember that the pension is on top of the 3 to 4%, or whatever you choose as an appropriate SWR, of savings and other income that you can spend. If you saved any of it, your "SWR" would be negative! Mental Bucket 2 - investment income: Dip into it for an occasional bigger adventure that especially excites you (Everest?), and use the rest to satisfy your emotional need to save and reinvest to supplement long-term growth. Bucket 3 - Any capital on top of the income: tucked away for your considered use when you realize that, yes, you have plenty and always will. Just an idea.

Rich_by_the_Bay

Moderator Emeritus

Grep just described Lucia's Buckets of Money strategy. There are a lot of us who find that useful.

Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

What a great discussion! Wish it had been done so well (and all in one place) back when I went through the thought process of trying to decide when to pull the plug. Since it's too late for me, all I can offer is my own story.

At 51, my pension vested. At 56, it maxed out at about double the 51 option. Naturally, since I'm a great LBYM saver my NW increased dramatically year by year as well.

Clearly, I could have survived at 51 but I had dreams of something more in retirement than just survival. Additionally, I never "hated" my j*b for more than a couple of months at a time, and I had several multi-year periods when I actually enjoyed it.

I struggled with the exact questions and considerations you all have so eloquently expressed here. When, how much is enough, time vs. money, what then, etc...?

Finally, I calculated (as carefully as possible) what my "dream" retirement would cost and then went for that amount (with lots of safety factors thrown in). Even when I had "arrived", I still hung on because I found myself in one of those really "good" periods at wo*k. Then when everything went crazy at wo*k and my good assignments turned bad, I pulled the plug at 58 with just 3 days notice.

Long story short, I retired almost 3 years ago and moved to my dream spot and dream retirement. I now believe it was all worth it and that I made the right decision. But as I went through the process, it was torture. I found myself second guessing my second guesses. Depending upon the person, that may just be part of what we must go through when making such significant decisions.

So, I guess my advice is to decide what kind of retirement you want, decide how much it will cost and then don't work a day longer than you must to finance your dream.

(If you truly find yourself hating the j*b, forget my advice and pull the plug when you can survive!)

End of lecture.

Happy Lab*r Day!

At 51, my pension vested. At 56, it maxed out at about double the 51 option. Naturally, since I'm a great LBYM saver my NW increased dramatically year by year as well.

Clearly, I could have survived at 51 but I had dreams of something more in retirement than just survival. Additionally, I never "hated" my j*b for more than a couple of months at a time, and I had several multi-year periods when I actually enjoyed it.

I struggled with the exact questions and considerations you all have so eloquently expressed here. When, how much is enough, time vs. money, what then, etc...?

Finally, I calculated (as carefully as possible) what my "dream" retirement would cost and then went for that amount (with lots of safety factors thrown in). Even when I had "arrived", I still hung on because I found myself in one of those really "good" periods at wo*k. Then when everything went crazy at wo*k and my good assignments turned bad, I pulled the plug at 58 with just 3 days notice.

Long story short, I retired almost 3 years ago and moved to my dream spot and dream retirement. I now believe it was all worth it and that I made the right decision. But as I went through the process, it was torture. I found myself second guessing my second guesses. Depending upon the person, that may just be part of what we must go through when making such significant decisions.

So, I guess my advice is to decide what kind of retirement you want, decide how much it will cost and then don't work a day longer than you must to finance your dream.

(If you truly find yourself hating the j*b, forget my advice and pull the plug when you can survive!)

End of lecture.

Happy Lab*r Day!

Milton

Thinks s/he gets paid by the post

- Joined

- Apr 18, 2007

- Messages

- 2,360

Grep,

Carl Klaus, Taking Retirement: A Beginner's Diary (2000), might be of some interest. It is the journal of a university professor experiencing conflicting emotions as he nears retirement.

I found it to be boring and self-indulgent, but perhaps your tastes are different than mine.

Milton

Carl Klaus, Taking Retirement: A Beginner's Diary (2000), might be of some interest. It is the journal of a university professor experiencing conflicting emotions as he nears retirement.

I found it to be boring and self-indulgent, but perhaps your tastes are different than mine.

Milton

Koolau: Thank you for your post. I wish my peak pension would be achieved at an earlier age, as yours was - it would make things easier on me.

In my first post, I alluded to issues with politics and the administration here...

In a moment of idle thinking, I looked at the schedule of promotion and merit reviews (every few years) I'd face over the next decade. These can be perfunctory, but are more usually opportunities for grandstanding and back-stabbing among colleagues and the administration. I found myself wondering how much of this I could evade, and at what cost.

Tenured Professors, even those in institutions in which tenure has been seriously watered-down, can survive in their jobs with relatively minimum effort, but it comes at a cost. Have you ever seen a flock of birds pick on one of their own? I've watched an outcast swan be repeatedly attacked, one peck at a time, by the rest of a flock. This bird had almost no feathers left and its time on earth was not long. Yet it still clearly wanted to remain part of the flock. This is life as a tenured Professor when the institution wants you out. You suffer many indignities and slights, yet there's never a push so great as to force you out (it would result in a lawsuit), and no purchase with which to push back. Most in this situation endure in quiet misery because their entire lives center on their position, and because leaving would feel like defeat.

I doubt I'd face the above, as I'm fairly successful and well-liked. But as I alluded in my first post, I have serious issues with the politics and abuses of power here. This is an administration that insists on winning at any cost, regardless of the means, since relentlessly winning is its very source of power. Any challenge on an individual's part, and certainly any victory, must be punished. Staying means submitting, as the personal cost of any challenge is made so extremely high as to be prohibitive. Merely staying, at times, therefore feels like defeat... but so does leaving because of it!

To stay, I must learn to live with this, yet it seems only a lobotomy would allow me that grace. Better, I'd find a way to turn enduring the politics, etc., into winning, but this goal seems petty at some level too. Even better, I'd find a way to rise above it, remove the distractions of politics and power, and keep focus on my own goals. I'm still struggling with this. At least, shortly, I'll have the option of leaving at any point.

Sorry for the rant.

In my first post, I alluded to issues with politics and the administration here...

In a moment of idle thinking, I looked at the schedule of promotion and merit reviews (every few years) I'd face over the next decade. These can be perfunctory, but are more usually opportunities for grandstanding and back-stabbing among colleagues and the administration. I found myself wondering how much of this I could evade, and at what cost.

Tenured Professors, even those in institutions in which tenure has been seriously watered-down, can survive in their jobs with relatively minimum effort, but it comes at a cost. Have you ever seen a flock of birds pick on one of their own? I've watched an outcast swan be repeatedly attacked, one peck at a time, by the rest of a flock. This bird had almost no feathers left and its time on earth was not long. Yet it still clearly wanted to remain part of the flock. This is life as a tenured Professor when the institution wants you out. You suffer many indignities and slights, yet there's never a push so great as to force you out (it would result in a lawsuit), and no purchase with which to push back. Most in this situation endure in quiet misery because their entire lives center on their position, and because leaving would feel like defeat.

I doubt I'd face the above, as I'm fairly successful and well-liked. But as I alluded in my first post, I have serious issues with the politics and abuses of power here. This is an administration that insists on winning at any cost, regardless of the means, since relentlessly winning is its very source of power. Any challenge on an individual's part, and certainly any victory, must be punished. Staying means submitting, as the personal cost of any challenge is made so extremely high as to be prohibitive. Merely staying, at times, therefore feels like defeat... but so does leaving because of it!

To stay, I must learn to live with this, yet it seems only a lobotomy would allow me that grace. Better, I'd find a way to turn enduring the politics, etc., into winning, but this goal seems petty at some level too. Even better, I'd find a way to rise above it, remove the distractions of politics and power, and keep focus on my own goals. I'm still struggling with this. At least, shortly, I'll have the option of leaving at any point.

Sorry for the rant.

haha

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

This sure sounds like a rough place!

Ha

Ha

Milton

Thinks s/he gets paid by the post

- Joined

- Apr 18, 2007

- Messages

- 2,360

That's truly pathetic.Most in this situation endure in quiet misery because their entire lives center on their position, and because leaving would feel like defeat.

Rich_by_the_Bay

Moderator Emeritus

I'm reading a disconnect between what sounds like a toxic environment and lack of appetite for weathering battle after battle on the one hand, and your ambivalence about leaving (despite ample finances) on the other hand.

Even if you can stick it out and emerge intact, why would you want to? Figure that one out and you'll know when to pull the plug.

Even if you can stick it out and emerge intact, why would you want to? Figure that one out and you'll know when to pull the plug.

Achiever51

Thinks s/he gets paid by the post

- Joined

- Feb 28, 2007

- Messages

- 1,015

I'm reading a disconnect between what sounds like a toxic environment and lack of appetite for weathering battle after battle on the one hand, and your ambivalence about leaving (despite ample finances) on the other hand.

Even if you can stick it out and emerge intact, why would you want to? Figure that one out and you'll know when to pull the plug.

I agree. Maybe it's really the fear of the unknown...taking that step off the cliff. After all, no matter how much planning, reading, dreaming, questionning, whatever, you do before you actually retire, until you actually experience it, you don't really know what it's going to be like -- or if you you're going to be happy,

There is fear of the unknown, to be sure, and I'd be giving up quite a bit of genuine value and satisfaction in my life. How will I do without the mantle of my position? How will I give up the perks and security of one more year? Will I leave with a bad taste in my mouth that will haunt me? What will I do instead? Will I (have enough to) not just retire, but to thrive and genuinely do as I please? These are just a few things that come to mind.

Milton

Thinks s/he gets paid by the post

- Joined

- Apr 18, 2007

- Messages

- 2,360

Presumably you will speak the same language, eat the same food, enjoy the same hobbies, live in the same house, socialize with the same friends, etc.How will I do without the mantle of my position?

I.e., nothing will change, other than perhaps a slight drop in prestige. And prestige is merely high regard in the minds of strangers (why should you care what strangers think?).

Based upon the information provided in your previous posts, I suspect that the longer you linger, the worse the taste will become.Will I leave with a bad taste in my mouth that will haunt me?

Let's hope that you have enough intelligence and independence to choose your own pastimes, rather than requiring the artificial structure imposed by a workplace.What will I do instead?

No one can ever answer that question, if for no other reason than we cannot know with any precision our remaining lifespan or whether we will experience serious health issues.Will I (have enough to) not just retire, but to thrive and genuinely do as I please?

Similar threads

- Replies

- 24

- Views

- 2K

- Replies

- 19

- Views

- 1K

- Replies

- 14

- Views

- 759

- Replies

- 36

- Views

- 2K