In 2022 I made a big mistake and made a large withdrawal at the beginning of the years and then another one at the end of the year, not realizing I had made the first withdrawal. I had been taking next years income at the end of each year, still haven't made sense of what I did.

I just received notice from SSA about my IRMMA increase. The form says,

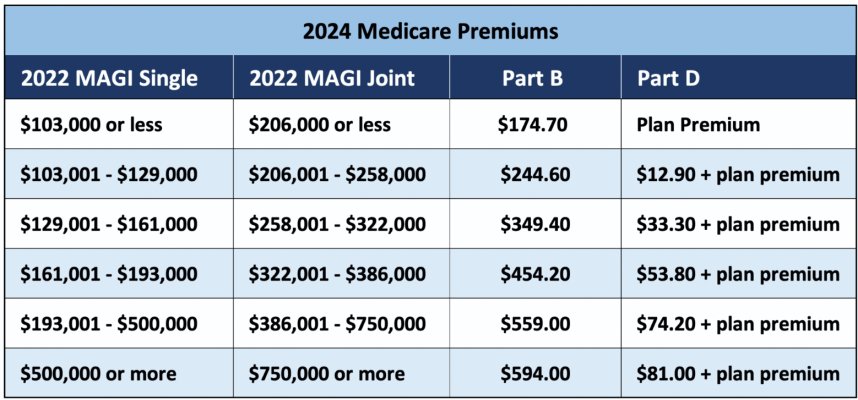

"If you have medicare part B, the total 2024 premium includes:

-- $174.70 for the standard Medicare premium, plus

-- any surcharges you may owe for late enrollment, plus

--$279.50 for the Medicare Part B IRMAA based on you 2022 income tax return."

Does that really mean I owe $174.70 + $279.50 = $454.20 every month for the next 12 months?

Shoot me now!

I just received notice from SSA about my IRMMA increase. The form says,

"If you have medicare part B, the total 2024 premium includes:

-- $174.70 for the standard Medicare premium, plus

-- any surcharges you may owe for late enrollment, plus

--$279.50 for the Medicare Part B IRMAA based on you 2022 income tax return."

Does that really mean I owe $174.70 + $279.50 = $454.20 every month for the next 12 months?

Shoot me now!