Interesting forecasting, boldfaced.* Let's revisit a year from now.* I bet the forecast is wrong.

SAN FRANCISCO, Sept 28 (Reuters) - The slowdown of California's housing market has become a drag on the state's economy as home building and financing payrolls thin, but the most populous U.S. state will avoid recession through 2008, according to a UCLA Anderson Forecast report.

The report, released on Thursday, projected California will through 2008 post overall payroll growth of around 1 percent, a rate similar to that in the first half of this year.

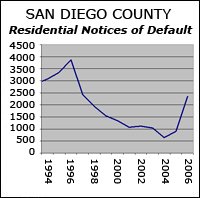

"The housing market has continued to soften and real estate-related employment has moved from a major engine of growth in 2005 to a drag on growth in 2006," the report said.

"Looking forward, the forecast calls for a similar picture," the report said. "Real estate sectors will continue to decline, but without significant declines in another sector, the net result will be a slowdown, not a recession."

Building permits in California will continue to decline, hitting bottom in 2008, the report noted.

A separate report by the economic forecasting group predicted that while home sales in California fall, home prices will not.

The report said California's homes market is "very far from a Great Comeuppance in which the extraordinary appreciation of the last five years is taken away."

"Here in California, though sales rates have plummeted, prices overall continue to push upward, though at a much slower rate, while some cities have experienced modest price declines," the report said.

Without severe job losses forcing home owners to sell houses, home prices in California in five years will be about the same as today, the report added.