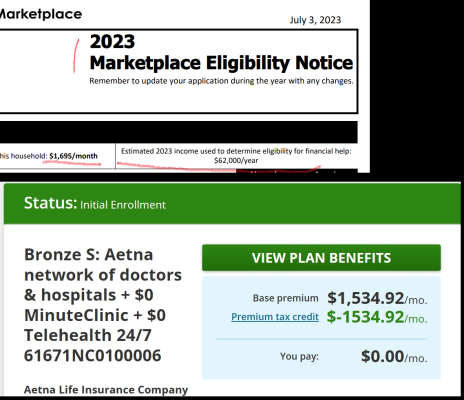

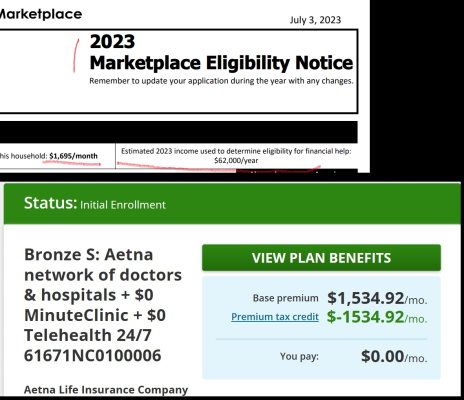

So, I just enrolled in ACA Healthcare.gov and choose Aetna insurance. Premium is $0.00.

It's asking me to pay. And when I try to put my credit card and complete the 0.00 payment, it says it cannot be less than $0.01.

Should I just wait for instructions from the Insurance company.

Anyone experience this?

It's asking me to pay. And when I try to put my credit card and complete the 0.00 payment, it says it cannot be less than $0.01.

Should I just wait for instructions from the Insurance company.

Anyone experience this?