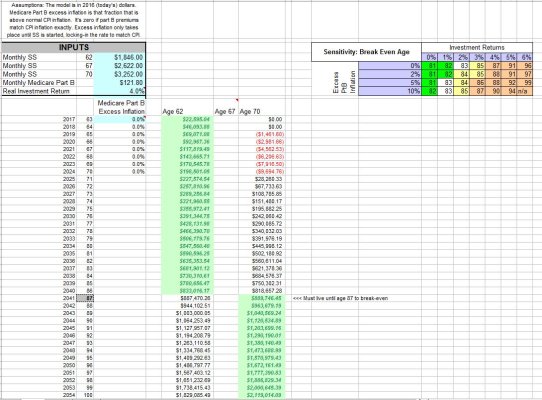

When I do my calculations with 0% inflation and 0% CPI, ~80 years of age is what I come up with the break even, the same as pb4uski.

If you assume a 100% safe investment will perform a bit less than inflation, and CPI will equal inflation, the differences get even larger for the benefit of delaying. That is a harder thing to calculate (for me...).

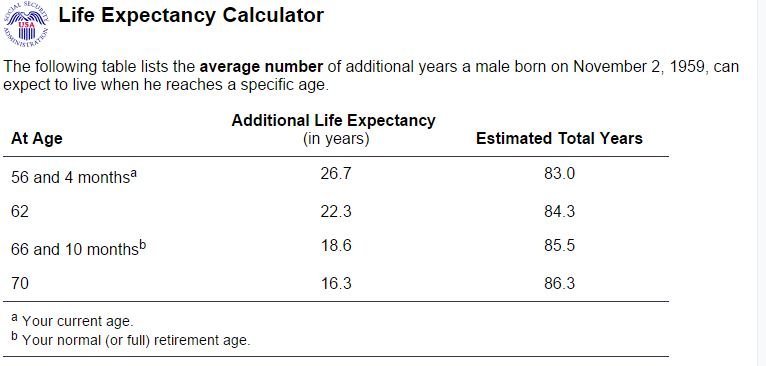

Factoring in the average age you will likely live, it makes sense to delay more. If you make it to 62, you will likely (50% chance) be able to make it to 84+. You have a ~60% chance of making it to 80. Knowing your health status at 62 (and 63, 64, etc.) you can put the odds more in your favor. If you make it to 70, you likely make it to 85 or beyond.

https://www.ssa.gov/oact/STATS/table4c6.html

Could you get a better return in Stocks? Or an Annuity?

One thing that would be interesting is to determine what an annuity would return if you put 100% of your SS into an annuity from age 62 to 70. Assuming that the insurance company would be safe. The annuity could have a survivor benefit. And a inflation rider. And a death benefit.

Could you get a better with the annuity than waiting on SS? I am guessing that you could not even come close to the value of a SS benefit.

One of the reasons I waited until 55+ to retire is to make sure that SS would likely not change for me. It solidifies one component of my plan. I should have a decent lifestyle with or without it. If you do not have enough money to live a good life style, take SS when you need it.

I see people that have had heart attacks and by-passes that think they will still make it to 90. Or smokers that think they will live longer than average. You may be lucky, but life expectancy is a very known quantity. Even when taking that OMY, you should look at your life expectancy.

I am surprised of some people that are so worried about staying in the 15% tax bracket that they are leaving money on the table that they could be using to enjoy the last good years of their lives. Let's face it, your life at 62 will likely be exponentially better than at age 70. Take SS at 62 and bump up a tax bracket. Live life.

If you have enough money to be able to make the choice, and are reasonable healthy, let it sit. From a financial and statistical standpoint, that is the best investment.

https://www.ssa.gov/OACT/population/longevity.html