Interesting work, Zero. Correct me if I am wrong- you assumed 3% after tax earnings on the saved money?

The only issue I can mention is that you choose a value for the SS cola, and in its present form the SS cola is unbounded, at least on the upside.(Not sure about downside.)

This is an issue that I think should be decided by one's goals, and predicitons for the future. Perhaps because of my age and adult householder experience of the 70s I have never wanted to own nominal interest debt longer than a few years-unless interest rates are very high and it appears that something might happen to change that.

So owning the nominal annuity would not appeal to me. However, the risk of having the government mess with SS may be at least as large as the risk of inflation quite a bit over 3%.

I realize that interst rates would very likely respond to higher inflation also, but having the larger portion with full cola would sooner or later dominate, and thus perhaps make the age 70 option a better longevity insurance policy.

Ha

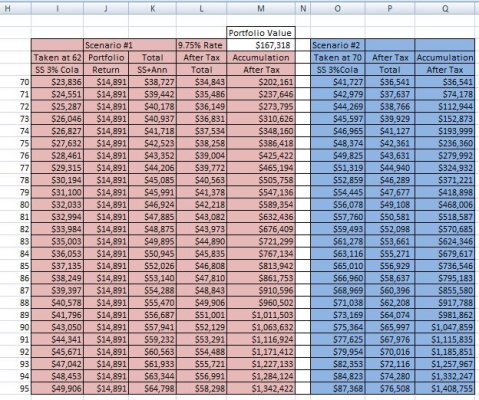

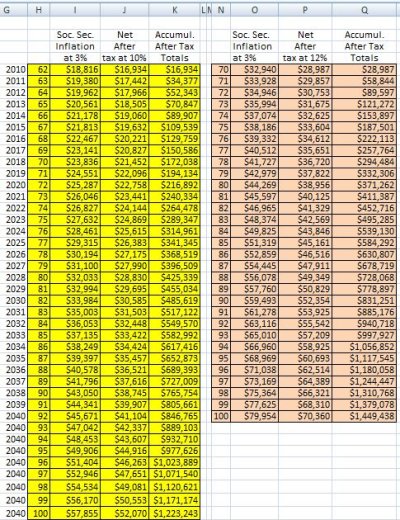

I did assume 3% earned on the after tax SS money.

As you point out, guessing at a COLA is one of the really difficult issues. We could easily see a few years of deflation, or stagflation or 12% inflation in 5 years.

In the case I ran, the private annuity amounted to about 1/3 and the SS annuity was about 2/3. So it accounts for only 2/3 of the inflation requirements. And as you say, "what plans hath the SS monsters", or something like that, I see pale, gaunt figures with money signs for eyes coming my way. SS zombies.

Not to hijack this thread but the next 10-20 years could be the most interesting times of our lives. Those of us who lived thru the 50's to 2010 have seen monumental changes, the near future may exceed that.