I agree from an incomewise analysis of SS only. But a person still has to provide their income to get from 62 to 70. So isn't it a trade of which source of income will be most advantageous to tap?

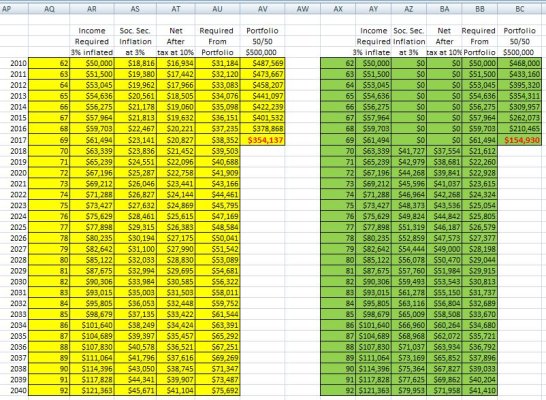

For instance if I only need $18,816 in year 62 to live on, I have two choices, take SS or take some % from my portfolio. If my portfolio was $470,000 that's a manageable 4% withdrawal, if my portfolio was $188,160 the 10% withdrawal would exhaust the portfolio in the 8 year period till age 70.

OK, since more than 1 person on here cant seem to see the scalibility of this concept let me use a different example. i will give an example using your SS numbers

Actuals from SS form:

SS est at 62 = $1568 or $18,816

SS est at 70 = $2745 or $32,940

the assumptions:

1) a single person at the age of 61.75 yoa is deciding whether to take his/her SS at age 62 or age 70. his/her SS numbers are identical to yours.

2) this single person has determined that s/he needs $52,940/yr to live on for the rest of his/her life but would like to spend more than that between the ages of 62 and 70.

3) this single person has a portfolio of $853,100, all in a tax defered account.

4) this single person has access to an account (bank, S&L, CU, MM) that pays interest that keeps up with inflation inside his/her tax defered account.

5) since everything i will talk about is adjusted for inflation i will assume, for ease of computation, inflation = 0%

now for simplicity i will examine 2 cases, starting to take SS at 2 ages:62 and 70.

1) taking SS at age 62:

required income = $52,940

SS income = $18,816

portfolio income per 4% rule = $853,100*4% = $34,124

total income = $18,816 + $34,124 = $52,940

therefore, in this example, this single person has just enough SS income and portfolio size to provide the $52,940 required to live but this person cant spend any more between ages 62 and 70.

2) taking SS at age 70:

this has 2 time periods, before age 70 and after age 70, and i will do them starting with after age 70 first: since s/he is starting SS at age 70 his/her SS income will be $32,940 thus s/he needs another $20,000 to cover his/her income needs. $500K of his/her portfolio will be needed to provide this $20,000 starting at age 62, going for 30 yrs. this leaves $353,100 to be used to fill that income gap between age 62 and 70

sooo looking at the years before age 70 s/he can just divide his/her the $353,100 by the 8 years needing income and s/he can spend:

$353,100/8 + $20,000=$64,137.50/yr.

since the $353,100 part of the portfolio can (and probably should for this example) be liquidated and put in that account that keeps up with inflation for these 8 years the income will be adjusted for inflation too.

now in this example (taking SS starting at age 70), the single person has enough income to support his/her $52,940 requirement for the rest of his/her life (30 yrs) PLUS can spend an additional, inflation adjusted $11,197.50 ($64,137.50 total) per year for each year between the ages 62 and 70.

and what if you wanted additional income for life? well then again you need to take SS at age 70. you liquidate $263,520 of your portfolio and put it in that account that keeps up with inflation which you will use $32940/yr of each year between age 62 and 70 (after age 70 SS provides this amount for the rest of your life). you then take 4% of the remaining portfolio ($589,580) resulting in $23583.20/ yr. adding these 2 yearly amounts together we get $56,523.20/yr for the 30 yr plan (which is $3583.20 more for the 30 yr plan that the 30 yr plan that has you starting SS at age 62). it is just a question of when you want to spend it.