I've learned a lot about the SS rules around spousal benefit - but I'm wondering what the community here thinks about spousal filing strategies.

Our situation:

Me = born in 1965, primary earner, planning on filing at FRA or later

DW = born in 1961, qualifies for SS but much less than mine

Question:

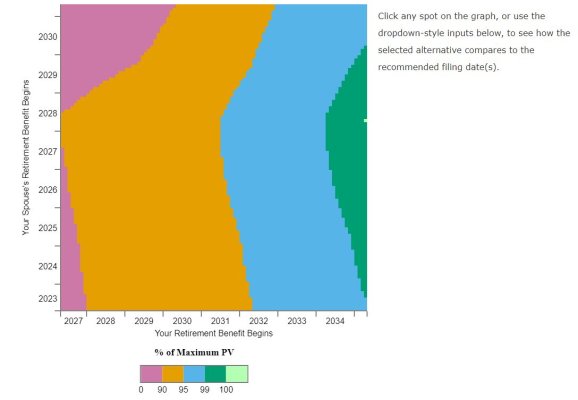

Should DW file at 62 and collect on her record for all of the years prior to me filing before uplifting to spousal benefit? Or should she delay a year or two and still collect on her record for a few years prior to me filing and then file for spousal uplift?

Or since I'm lazy today - is this just a simple spreadsheet model (which i assume is the case and apologize in advance).

Our situation:

Me = born in 1965, primary earner, planning on filing at FRA or later

DW = born in 1961, qualifies for SS but much less than mine

Question:

Should DW file at 62 and collect on her record for all of the years prior to me filing before uplifting to spousal benefit? Or should she delay a year or two and still collect on her record for a few years prior to me filing and then file for spousal uplift?

Or since I'm lazy today - is this just a simple spreadsheet model (which i assume is the case and apologize in advance).