I'm not sure I understand the concern about 1/1 here unless someone wants to take their whole RMD right away. We just draw as we need money and monitor where we are with the RMD number to make sure we're compliant by year end. No urgency at all to know an exact number.

I'll explain the concern.

Before doing so, let me point out that my concerns are over something that is not a big deal, so people are feel to consider me to be obsessing over nits or whatever other phrase they would like to use.

As mentioned above, my father has his traditional IRA at Vanguard. He is 85 and therefore is subject to RMD rules. Being 85 and of lessened mental acuity, he has set up an automatic RMD, which is a service Vanguard offers to their clients. He has chosen to set it up so that the sale of assets within the IRA, the federal income tax withholding, and the transfer to his taxable account all takes place automatically. He has further chosen to do these withdrawals monthly on the 15th of the month.

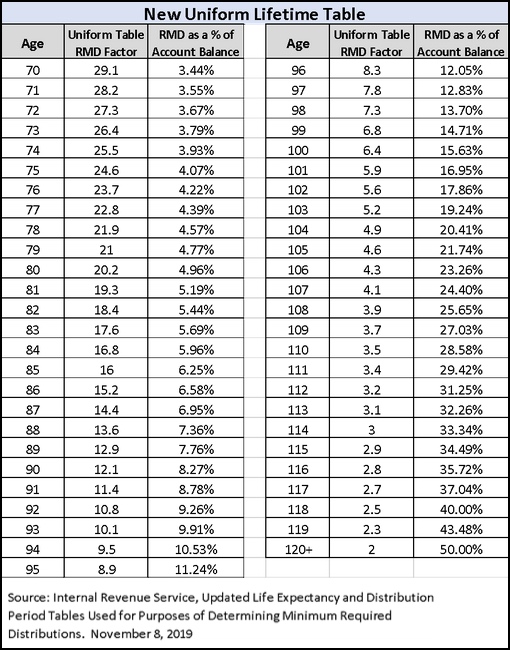

So Vanguard automatically looks at his age and 12/31 IRA balance, calculates his RMD based on the RMD table, and then takes 1/12th of that amount every month.

This benefits my Dad because he doesn't have to worry about his RMD (he sometimes does anyway as he is a bit forgetful), minimizes his taxable income, and gives him an even and regular cash flow.

If the new tables are not approved in time, Vanguard will presumably use the existing RMD table, make the RMD calculation, divide by 12, and do a transaction on 1/15/21 with that number.

If the new tables subsequently are approved for 2021 use, then my Dad's 1/15/21 withdrawal will be about 8.1% too much. Depending on when in the year Vanguard is able to switch over to the new table, my Dad's 2/15/21 withdrawal may be too much by 8.1% as well. Ditto for March, April, May, etc.

It is unclear what Vanguard will do or should do in this case. Switch to the new, 8.1% lower amount part of the way through the year? Keep taking out 8.1% too much? Let my Dad decide? Take out proportionally less for subsequent months so that only his RMD is taken out?

Whatever happens, it is likely to make it harder for my Dad to achieve his goals of simplicity, tax minimization, RMD compliance, and regular even income in 2021.

Again,

totally not a big deal, and I'm sure Vanguard and my Dad will make good choices and we'll make it work, but those are the concerns I have.

Heh, heh, also sounds like w*rk!

Heh, heh, also sounds like w*rk! I just pull once a year, usually within the first quarter. I stick it all in the checking account and use out of that for the rest of the year. Absolutely, that means I leave (potential) gains behind. Since I can live without the gains and (realistically, without taking significant investment risk) it ain't that much. That way, I never have to REMEMBER to be SURE I've taken out enough to avoid the draconian penalties either. Your way is much more elegant. I'm okay with mine even though YMMV.

I just pull once a year, usually within the first quarter. I stick it all in the checking account and use out of that for the rest of the year. Absolutely, that means I leave (potential) gains behind. Since I can live without the gains and (realistically, without taking significant investment risk) it ain't that much. That way, I never have to REMEMBER to be SURE I've taken out enough to avoid the draconian penalties either. Your way is much more elegant. I'm okay with mine even though YMMV.