audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

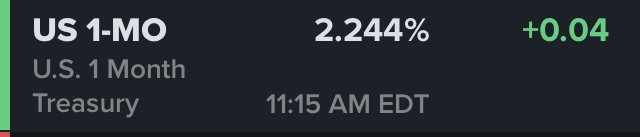

Thanks. I just looked and the auction dropped to 2.326% and the 2 secondary bills increased to 2.362% and 2.360% respectively. It's small differences when talking about 1 or 10 T bills, it might be more important if you're buying hundreds of T bills. My desire to maximize this for the "best/perfect" outcome is not worth the trouble. I was more interested in whether I understood the yields of the 2 secondary bills and if not where do I look. Either purchasing option seems to work, I think I'll buy 1 on the secondary market today to see how it works like when I bought my 1st at auction.

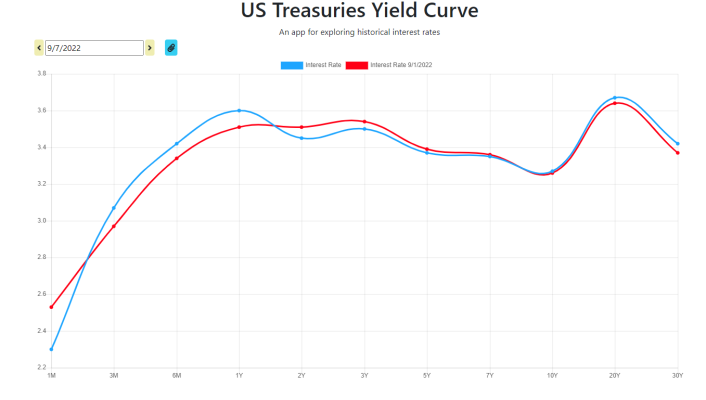

I’m confused. The next 4 week T-bill auction is tomorrow 9/8 so it hasn’t happened yet. Last week’s came in at 2.509%.

I think all the info you have right now is where the secondary market is trading. You don’t know the auction yield yet.

Last edited: