(I am using TurboTax Deluxe PC Download)

Form 1116 (Foreign Tax Credit) was finally released today. TurboTax supports it for e-file. However, if you have a Foreign Tax Credit carry-over from previous years you must also file Form 1116 Schedule B which will not be released until 3/31, and is not supported for e-file. Therefore -- per Intuit -- if you want to use a Foreign Tax Credit Carry-over, you must wait until 3/31 for the form and then mail in your return.

I paid $932 in Foreign (VEU) in 2021 and have a carry-over of $411 from 2020 available. TTax automatically populates/utilizes the carry-over and then informs me I need Form1116 Schedule B and cannot e-file.

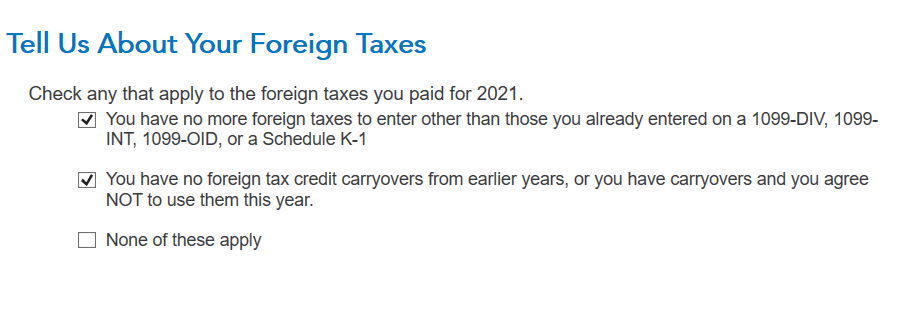

From the Intuit complaint forum, it appears that the ONLINE version offers the option of deciding not to use your carry-over this year – and presto! 1116-Schedule B is not needed and the return can be e-filed. (one hopes the carry-over will be available for future years)

The PC version does not have the “don’t use my carry-over” checkbox. However, if I go into the 1116 Worksheet and override the $411 carry-over with $0, then – presto! 1116-Schedule B is not needed and the return can be e-filed.

I am quite willing to forgo the $411 carry-over credit this year in order to e-file now rather than waiting until after 3/31, printing/mailing my return, and sending it to the IRS morass. I have a $7,000 refund due.

But having never over-ridden a value in 20+ years of using TurboTax, I’m a bit nervous: will manually overriding the carry-over to $0 in the worksheet cause flags at the IRS? If I do this, the government is ahead by $411…

Is anyone else in this pickle?

Form 1116 (Foreign Tax Credit) was finally released today. TurboTax supports it for e-file. However, if you have a Foreign Tax Credit carry-over from previous years you must also file Form 1116 Schedule B which will not be released until 3/31, and is not supported for e-file. Therefore -- per Intuit -- if you want to use a Foreign Tax Credit Carry-over, you must wait until 3/31 for the form and then mail in your return.

I paid $932 in Foreign (VEU) in 2021 and have a carry-over of $411 from 2020 available. TTax automatically populates/utilizes the carry-over and then informs me I need Form1116 Schedule B and cannot e-file.

From the Intuit complaint forum, it appears that the ONLINE version offers the option of deciding not to use your carry-over this year – and presto! 1116-Schedule B is not needed and the return can be e-filed. (one hopes the carry-over will be available for future years)

The PC version does not have the “don’t use my carry-over” checkbox. However, if I go into the 1116 Worksheet and override the $411 carry-over with $0, then – presto! 1116-Schedule B is not needed and the return can be e-filed.

I am quite willing to forgo the $411 carry-over credit this year in order to e-file now rather than waiting until after 3/31, printing/mailing my return, and sending it to the IRS morass. I have a $7,000 refund due.

But having never over-ridden a value in 20+ years of using TurboTax, I’m a bit nervous: will manually overriding the carry-over to $0 in the worksheet cause flags at the IRS? If I do this, the government is ahead by $411…

Is anyone else in this pickle?

Last edited: