corn18

Thinks s/he gets paid by the post

- Joined

- Aug 30, 2015

- Messages

- 1,890

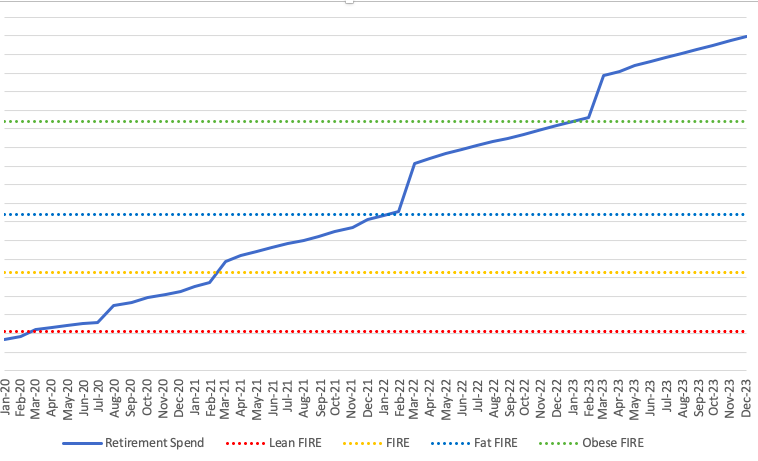

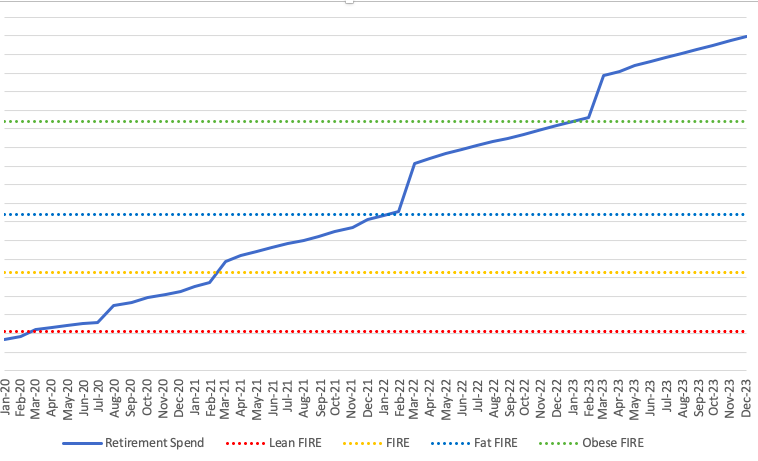

Based on the below graph, when would you retire?

Lean FIRE @ 54 = base budget covered, no blow that dough (BTD)

FIRE @ 55 = comfy budget with 10% BTD

Fat FIRE @ 56 = roomy budget with 20% BTD

Obese FIRE @ 57 = kids get a lot of money

For ref, I am 53, turn 54 Mar 2020.

Lean FIRE @ 54 = base budget covered, no blow that dough (BTD)

FIRE @ 55 = comfy budget with 10% BTD

Fat FIRE @ 56 = roomy budget with 20% BTD

Obese FIRE @ 57 = kids get a lot of money

For ref, I am 53, turn 54 Mar 2020.

Last edited: