I guess the lesson I learned was, do not make large changes to investments at 1am... I am very annoyed about this whole experience, and hope it can be a lesson to others.

Last night I decided to move all of my Vanguard Intl Value fund into a better allocation, the target retirement. I had just bought the Intl Value a few weeks ago, and hadn't even occured to me to check the prospectus under "fees and expenses". I assumed, if there were any issues with trading it, it would be on the confirmation page when I went to exchange the fund.

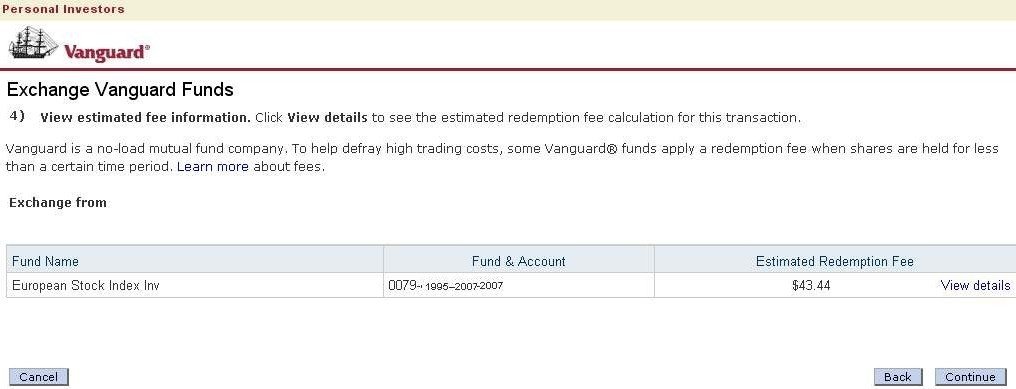

So, I clicked on exchange all vanguard intl value, selected fund to exchange to, Target Retirement 2045, it brought up a page that basically said "are you sure you want to make the exchange?" Nothing about exchange fees, trading expenses, anything. Just simply a "submitting this will make the exchange". I hit confirm.

The next screen, to my bewilderment, was "Thank you. Since you purchased within the last 60 days, you have now been assessed a 2% fee. The total will be $450"....

Now, had this been on the screen PRIOR to the confirmation, like the "submitting will make the exchange" page, I OBVIOUSLY would have held it for another week or two just to make this requirement. But I feel bamboozled, as if they PURPOSELY do this to collect a hefty fee.

So, this morning I call, assuming that I made the trade in after hours, and the exchange will not take place till after market close today. I call as soon as they open, 8am.

Representative: Sorry, it is our policy not to cancel orders made through the web.

Me: Ok, well I feel as if I had been jerked around, can I speak to a manager?

Representative: Sure, but they can't cancel it either, nor can they change the redemption fee.

Me: I'll take my chances, let me speak to one.

Manager: Hi, I am aware of your situation, and I also can not cancel this transaction, but I will have tech support look through the screens and if it didn't present something, we might be able to waive the 2% fee. It might take two weeks though to do the research, is that ok?

Me: Sure.

Manager: Ok hold on, let me contact tech support.

*wait 5 minutes on hold*

I am assuming by this point, tech support has told her exactly the fact that they don't present that information on the screen to screw people over, and to just say "I should have read through the prospectus".

Manager: Sir, apparently we can't do the screen shot thing. But the redemption fee is printed in the prospectus under fees.

Me: Yes, there are also another 15 fees under there, minimum balance fee, index fund quarterly assessed fee, etc etc. You expect me to read every prospectus before I do any sort of transaction in any fund? Furthermore, I'm a programmer and know that if you have the information once the submit button is pressed, you obviously had it before the button was pressed. You purposely don't present it. I also wanted to put more money into some of your funds, but after this, I feel like I should probably just stay with my regular broker and use ETFs. It is hard to believe with all the competition you are receiving in the index world, there is nothing you can do for me.

Manager: Sorry. I won't waive the fee. Anything else I can help you with today?

*click*

What mostly annoyed me was the fact that she used the word "won't". If she had said it was out of her power to waive it, that is one thing. This simply seems like a "he is small beans, so who cares if we lose him as a customer". Perhaps if I was a voyager client, things would have gone differently. Unfortunatly, at this point, I doubt I will reach that status as I will read everything very closely on the fees page, and once I am DCA'd in, drop it all and stick it into ETFs instead (ishares, spiders, whoever). Brand loyalty, be damned...

I've heard other horror stories of their customer service, and just wanted to add yet another. Watch those fees assessed, they can certainly add up over time. $10 here $10 there basically equates to a commision, and dealing with an ETF they can't hit you with any redemption nonsense.

This has sort of become a "principle" thing with me now, and I'm going to do some research and see if there is anything I can do. Luckily the wifey is an attorney, so maybe she can come up with something clever

Last night I decided to move all of my Vanguard Intl Value fund into a better allocation, the target retirement. I had just bought the Intl Value a few weeks ago, and hadn't even occured to me to check the prospectus under "fees and expenses". I assumed, if there were any issues with trading it, it would be on the confirmation page when I went to exchange the fund.

So, I clicked on exchange all vanguard intl value, selected fund to exchange to, Target Retirement 2045, it brought up a page that basically said "are you sure you want to make the exchange?" Nothing about exchange fees, trading expenses, anything. Just simply a "submitting this will make the exchange". I hit confirm.

The next screen, to my bewilderment, was "Thank you. Since you purchased within the last 60 days, you have now been assessed a 2% fee. The total will be $450"....

Now, had this been on the screen PRIOR to the confirmation, like the "submitting will make the exchange" page, I OBVIOUSLY would have held it for another week or two just to make this requirement. But I feel bamboozled, as if they PURPOSELY do this to collect a hefty fee.

So, this morning I call, assuming that I made the trade in after hours, and the exchange will not take place till after market close today. I call as soon as they open, 8am.

Representative: Sorry, it is our policy not to cancel orders made through the web.

Me: Ok, well I feel as if I had been jerked around, can I speak to a manager?

Representative: Sure, but they can't cancel it either, nor can they change the redemption fee.

Me: I'll take my chances, let me speak to one.

Manager: Hi, I am aware of your situation, and I also can not cancel this transaction, but I will have tech support look through the screens and if it didn't present something, we might be able to waive the 2% fee. It might take two weeks though to do the research, is that ok?

Me: Sure.

Manager: Ok hold on, let me contact tech support.

*wait 5 minutes on hold*

I am assuming by this point, tech support has told her exactly the fact that they don't present that information on the screen to screw people over, and to just say "I should have read through the prospectus".

Manager: Sir, apparently we can't do the screen shot thing. But the redemption fee is printed in the prospectus under fees.

Me: Yes, there are also another 15 fees under there, minimum balance fee, index fund quarterly assessed fee, etc etc. You expect me to read every prospectus before I do any sort of transaction in any fund? Furthermore, I'm a programmer and know that if you have the information once the submit button is pressed, you obviously had it before the button was pressed. You purposely don't present it. I also wanted to put more money into some of your funds, but after this, I feel like I should probably just stay with my regular broker and use ETFs. It is hard to believe with all the competition you are receiving in the index world, there is nothing you can do for me.

Manager: Sorry. I won't waive the fee. Anything else I can help you with today?

*click*

What mostly annoyed me was the fact that she used the word "won't". If she had said it was out of her power to waive it, that is one thing. This simply seems like a "he is small beans, so who cares if we lose him as a customer". Perhaps if I was a voyager client, things would have gone differently. Unfortunatly, at this point, I doubt I will reach that status as I will read everything very closely on the fees page, and once I am DCA'd in, drop it all and stick it into ETFs instead (ishares, spiders, whoever). Brand loyalty, be damned...

I've heard other horror stories of their customer service, and just wanted to add yet another. Watch those fees assessed, they can certainly add up over time. $10 here $10 there basically equates to a commision, and dealing with an ETF they can't hit you with any redemption nonsense.

This has sort of become a "principle" thing with me now, and I'm going to do some research and see if there is anything I can do. Luckily the wifey is an attorney, so maybe she can come up with something clever