audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

2000 - 2013 wasn’t no walk in the park either when you look at total return in real terms.

Hi, I am new here.I retired a few years ago @58. I have a very conservative portfolio with about 75% in 3.25% brokered CDs good for 3 more years, 10% in total stock, and 15% cash. NW minus Real Estate is 43X annual spend.

I can't get used to not having 'for-sure' income. I guess when my pension and SS kick in... I will be less nervous going back to ~40% equities. Are there people here doing like me? FOMO is building. I want to be told to shut up and just be happy.

Well, @JRon implicitly asks the important question #1: "What is the purpose of your large stash?" When Alice (in Wonderland) asked the Cat: "Would you tell me, please, which way I ought to go from here?" The answer was: "That depends a good deal on where you want to get to." If you have won the game and have no desire to leave an estate, that points to one investing strategy. If you want to leave a large estate for family and charity, that points to a different strategy.

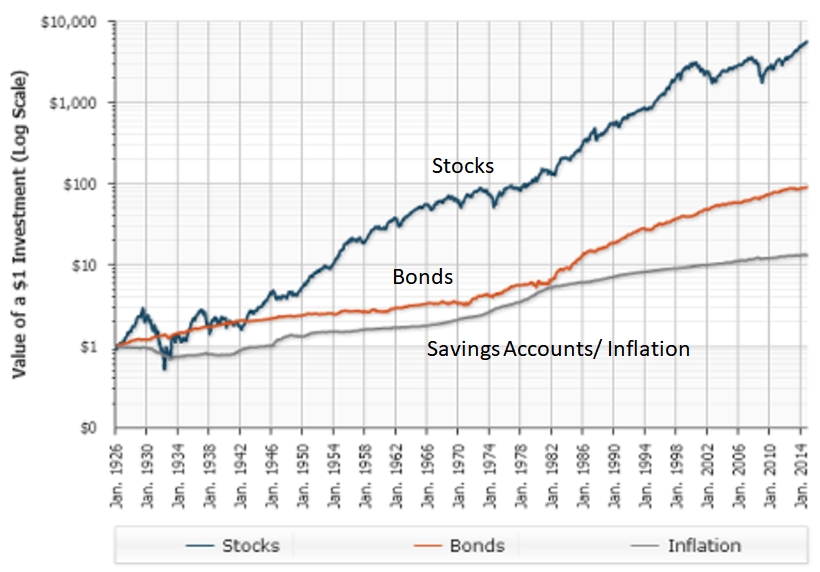

Now, about that chicken ... My guess is that the chicken is confusing volatility with risk. That's very common. Here is a chart I use in my Adult-Ed investing class:

Note two things: First, equities are indeed more volatile than the alternatives. Second, they are quite reliably more profitable. A lot more profitable. Also, there has never been a drop from which the market hasn't recovered in a few years. Is this history predictive? It has been so far.

So, the investing problem for the chicken may be simply to invest so that she can ride out the dips but stay on the equity gravy train. How much? See question #1.

Hi, I am new here.I retired a few years ago @58. I have a very conservative portfolio with about 75% in 3.25% brokered CDs good for 3 more years, 10% in total stock, and 15% cash. NW minus Real Estate is 43X annual spend.

I can't get used to not having 'for-sure' income. I guess when my pension and SS kick in... I will be less nervous going back to ~40% equities. Are there people here doing like me? FOMO is building. I want to be told to shut up and just be happy.

Now, all we have to do is figure out where to put those maturing CDs and how to replace as much of that income as possible. That's a topic for another post

At age 77 with a very sick DW, our equity allocation is about 20%. Our 3+% CD's expired last year and I have been buying preferred stocks that pay 4 - 7% and are pretty safe to replace the lost CD interest. I have about a dozen issues and monitor them frequently. There's a big thread here on us guys who do this.

I also sell covered calls and cash secured puts in small quantities on select stocks. That helps from the income side of it.

One thing I did learn (painfully) is that dividends often come at the cost of total return. I did read many threads over the years downplaying dividends and advocating for a focus on TR and generally disagreed - until it happened to me with my little $50K dividend paying stock portfolio. Yep - most of those stocks have been red (vs green) for a long time, especially CTL (now LUMN)..tough to always look at those and see red TR numbers, dividends aside..

Would love to hear more about that. Could you plz post a link to your preferred stocks thread for those who are interested?

ETA - might be a dumb question, but what's the reason for Preferred vs. "Normal" stocks when it comes to dividend payers?

If I'm reading your comment correctly, you may not be understanding Total Return properly. Total Return is the stock price, but it also includes the dividends. So if the stock price is in the red, but the dividends put your return over cost basis in the green, the TR is green. With my few dividend paying stocks I don't care in the least if their price goes up, as long as the dividends keep rolling in. If the price goes up, that's better, but it's not the reason I own them. Now, if the stock price drops enough to counter the dividends, that's not good. And obviously dropping the dividend is the worst case. But they announce that ahead of time, and it's up to you to get out before you lose too much (hard to do).

(IMHO):

Chasing nice high dividend stocks, often leads to disappointment as the company cuts the div or cancels it. As soon as either one happens the price drops because people ditch the stock like a hot potato. This compounds the problem for the div chaser, as selling will often mean a loss.

I've done this now and then myself.

My recent one is T, for the 7% div. I have zero expectation that stock will go up, I just want it to stay the same and continue to pay 7%.

Currently, for some money that I am mostly interested in dividend generating, one thing I invest in is an ETF (big collection of stocks) SCHD. The div is ~3% which is better than a CD, and there is some safety in that should a couple of companies stop paying the div or even go bankrupt, the div will still continue only slightly affected, and the price will go down only a few percent.

I'm clear on Total Return..guess my point was that certain stocks (eg: CTL/LUMN) have cratered to the point that even the dividends paid to date don't get me back to green..

ETA - the other thing I experienced which was for the most part unexpected was divvy cuts. Happened to me on Welltower, F (eliminated completely) and CTL (54% cut)..so, in those cases - double whammy of dropping share price AND reduced or eliminated dividends..

The nice feature with T is one can sell call and put options on it forever as it bounces between $27 and $34. That's what I have been doing for a year now.

Hi, I am new here.I retired a few years ago @58. I have a very conservative portfolio with about 75% in 3.25% brokered CDs good for 3 more years, 10% in total stock, and 15% cash. NW minus Real Estate is 43X annual spend.

I can't get used to not having 'for-sure' income. I guess when my pension and SS kick in... I will be less nervous going back to ~40% equities. Are there people here doing like me? FOMO is building. I want to be told to shut up and just be happy.

(IMHO):

Chasing nice high dividend stocks, often leads to disappointment as the company cuts the div or cancels it. As soon as either one happens the price drops because people ditch the stock like a hot potato. This compounds the problem for the div chaser, as selling will often mean a loss.

I've done this now and then myself.

My recent one is T, for the 7% div. I have zero expectation that stock will go up, I just want it to stay the same and continue to pay 7%.

Currently, for some money that I am mostly interested in dividend generating, one thing I invest in is an ETF (big collection of stocks) SCHD. The div is ~3% which is better than a CD, and there is some safety in that should a couple of companies stop paying the div or even go bankrupt, the div will still continue only slightly affected, and the price will go down only a few percent.

The nice feature with T is one can sell call and put options on it forever as it bounces between $27 and $34. That's what I have been doing for a year now.

I didn't mention it in my previous post as it would just confuse the point I was trying to say.

I've sold covered calls on my T (just recently bought it).

While the option is not really much, I consider it just a bonus extraand if it goes, I might have to sell a Put.

You can afford to be conservative because you have 43X annual spending, so you should be fine.

I don't see that you have any issue at this time - there's nothing to do for another 3 years unless you are going to reallocate the remaining 25% to equities. Even if you did that, you wouldn't push the whole thing to equities or very aggressive equities, and so the additional income generated above what you're getting from the 10% total stock will likely not make that much of a difference, though you will certainly take on more risk.

Sit back, stick with what you have, and begin thinking about it again in 2.5 years. Who knows what CDs will be paying when yours are maturing and looking for reinvestment.

I'm at 1/99 (that's 99% in CDs and bonds) and I'm happy as a clam.

If you're comfortable with your AA and the numbers continue working out for your lifestyle, why rock the boat? FOMO is not a good state of mind - try to move away from that.

Bottom line, shut up and just be happy.

We have 0 stocks age 69 and 71. The problem is what to do with all the cd’s and bonds when they mature the next 2 to 4 years if interest rates are like now. We also have a couple GO muni’s that will probably be called early which will hurt,paying about 5 %.

The fed does a great job of saving all the stock holders but they never consider the retired people holding a ton of CD type investments.