Hi, I am new here. I retired a few years ago @58. I have a very conservative portfolio with about 75% in 3.25% brokered CDs good for 3 more years, 10% in total stock, and 15% cash. NW minus Real Estate is 43X annual spend.

I retired a few years ago @58. I have a very conservative portfolio with about 75% in 3.25% brokered CDs good for 3 more years, 10% in total stock, and 15% cash. NW minus Real Estate is 43X annual spend.

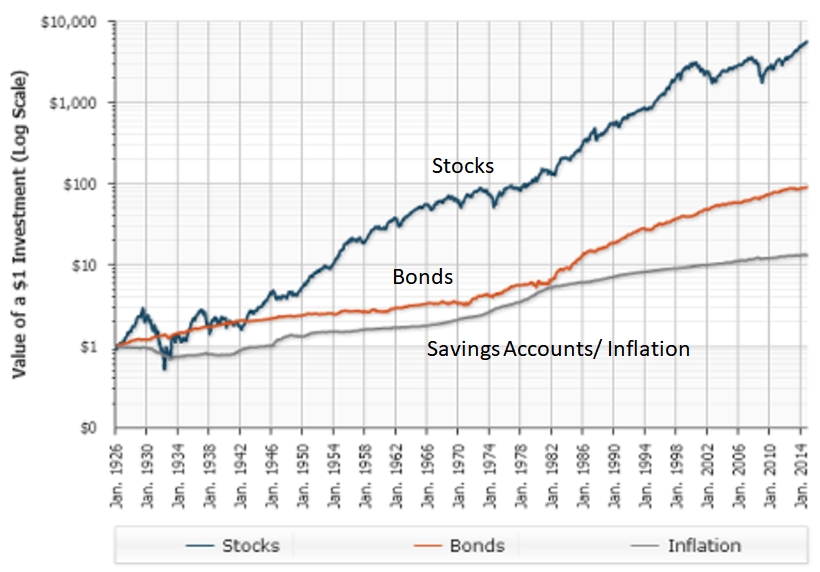

I can't get used to not having 'for-sure' income. I guess when my pension and SS kick in... I will be less nervous going back to ~40% equities. Are there people here doing like me? FOMO is building. I want to be told to shut up and just be happy.

I can't get used to not having 'for-sure' income. I guess when my pension and SS kick in... I will be less nervous going back to ~40% equities. Are there people here doing like me? FOMO is building. I want to be told to shut up and just be happy.