Yea, I got up way too early just to post this.

Differing from the author, I prefer to use math instead of emotion to determine fairness. The math is as follows:

US population 327,000,000

Annual State, local and Federal governmental revenue $6T*

Annual share per each man, woman and child in the US $18k

So, an

average family of 2.5 owes $45K ($18k x 2.5) annually just to cover their share of the costs to run the country.

Median family income is currently $60k. Using this measure of fairness, obviously a large number of Americans are not paying their fair share. (Fairness/privilege was the author's premise not mine.)

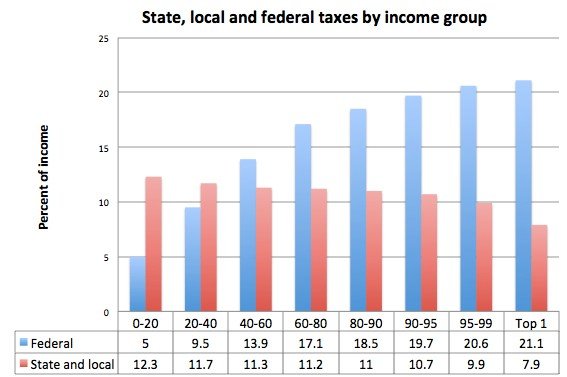

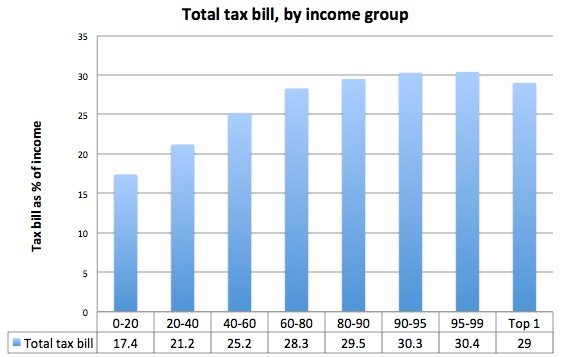

The numbers above would seem to indicate, as a society, we do a pretty good job of shifting societal costs to the wealthy and away from the poor. But, to authors like this it will never be enough. His idea of fairness is sameness. And as others have pointed out, that is not the human condition.

*Defecit spending puts the number closer to $7T. The above excludes

US annual charitable giving of about $390B, with the cost falling mostly to the wealthy and the benefit mostly to the poor or society in general.