You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Peak Oil?

- Thread starter imoldernu

- Start date

Lakewood90712

Thinks s/he gets paid by the post

- Joined

- Jul 21, 2005

- Messages

- 2,223

Supply and demand controls the short term prices. A small oversupply or shortage has huge forces on price. Some producers overseas have to sell at any price , just to pay the bills , and are reluctant to pull off production in an attempt to stabilize price.

The US is no where near self sufficient on oil.

PEAK OIL describes the peak production point of all the oil that can be produced ( All the oil that has been produced from the known sources) It can be pushed foreword many many years or decades , with a steeper decline thereafter.

Lots of oil still left to recover, not many finds from places not known to have oil. The rate of discovery is less than the rate of depletion.

It took hundreds of millions of years to "Make" the oil, and a few hundred years to use the easy oil.

Full disclosure : poster owns shares of those immoral polluting dirty oil companies

The US is no where near self sufficient on oil.

PEAK OIL describes the peak production point of all the oil that can be produced ( All the oil that has been produced from the known sources) It can be pushed foreword many many years or decades , with a steeper decline thereafter.

Lots of oil still left to recover, not many finds from places not known to have oil. The rate of discovery is less than the rate of depletion.

It took hundreds of millions of years to "Make" the oil, and a few hundred years to use the easy oil.

Full disclosure : poster owns shares of those immoral polluting dirty oil companies

Last edited:

Lakewood90712

Thinks s/he gets paid by the post

- Joined

- Jul 21, 2005

- Messages

- 2,223

Another factor for US retail gasoline and diesel/fuel oil prices. Most of the cost of gasoline and diesel is crude oil , with the US importing currently 40 % , a strong dollar  has a real effect on crude prices.

has a real effect on crude prices.

Enjoy the lower prices

Enjoy the lower prices

Last edited:

Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Peak Oil's move farther into the future makes my purchase of a hybrid auto a little less smart. It looks like my break even point will move from about 5 years to as much as 7 years if this keeps up.

Hopefully there will be some type of oil crisis with prices near $5 a barrel so my break even point improves.

Hopefully there will be some type of oil crisis with prices near $5 a barrel so my break even point improves.

Re: Lakewood90712...A good succinct answer in the shortest possible words. And I agree.

I used to work (indirectly) for Mobil and sat in a few meetings with Rawleigh Warner.

Here's a bit from Mobil... from last January.

US to achieve energy self-sufficiency by 2020: Exxon Mobil CEO

I guess the part that bothers me, is that the media slips from disaster to glory, without batting an eyelash.

So now, who do we believe? What happens when ISIL wipes out a few wells, or the Saudis change a few political commitments?

How many tankers are stacked, backed up? Is the Federal Emergency Reserve Full? Who hears about Eagle Ford, Bakken, Marcellus Shale and whether the known energy reserves are going up or down.

In short, how much do we know about what was arguably the underlying reason for intervention in Iraq? Despite spending and defending, with $$$ and lives, what do we really know about was was just recently THE defining concern for the future of the U.S.

I used to work (indirectly) for Mobil and sat in a few meetings with Rawleigh Warner.

Here's a bit from Mobil... from last January.

US to achieve energy self-sufficiency by 2020: Exxon Mobil CEO

I guess the part that bothers me, is that the media slips from disaster to glory, without batting an eyelash.

So now, who do we believe? What happens when ISIL wipes out a few wells, or the Saudis change a few political commitments?

How many tankers are stacked, backed up? Is the Federal Emergency Reserve Full? Who hears about Eagle Ford, Bakken, Marcellus Shale and whether the known energy reserves are going up or down.

In short, how much do we know about what was arguably the underlying reason for intervention in Iraq? Despite spending and defending, with $$$ and lives, what do we really know about was was just recently THE defining concern for the future of the U.S.

Lakewood90712

Thinks s/he gets paid by the post

- Joined

- Jul 21, 2005

- Messages

- 2,223

"In short, how much do we know about what was arguably the underlying reason for intervention in Iraq? "

"Nation Building"?

I thought this thread was about oil prices.

"Nation Building"?

I thought this thread was about oil prices.

Brat

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Right now the profit is in refineries.

Lakewood90712

Thinks s/he gets paid by the post

- Joined

- Jul 21, 2005

- Messages

- 2,223

ISIS is flooding the market to fund the war.

It's such a small amount, I would not call it "Flooding the market" , but oil captured by ISIS is getting to market thru Turkey, and Turkey seems to ignore it. So much for our US Allies in the region

Last edited:

aja8888

Moderator Emeritus

The Saudi's don't have the swing power they used to. Their big fields are in waterflood and they have not embraced horizontal drilling. They also have not found any new big fields.

There will be fighting in the Middle East for the foreseeable future as there has been since recorded history. A few million barrels of oil per day held hostage by them is becoming trivial in the big scheme of world inventory.

It's a good time to work in the oil & gas industry in the U.S. and Canada. I love it.

There will be fighting in the Middle East for the foreseeable future as there has been since recorded history. A few million barrels of oil per day held hostage by them is becoming trivial in the big scheme of world inventory.

It's a good time to work in the oil & gas industry in the U.S. and Canada. I love it.

Last edited:

I've been hearing about "peak oil" since I was 20 years old. I'm now 64 and haven't seen it yet.

There is a credibility gap.

There is a credibility gap.

Brat

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

ISIS is flooding the market to fund the war.

That could well be.

I heard an analysis today on NPR where one of those think-tank guys said that ISIS is running a huge deficit trying to manage territory. He described ISIS's military pay structure... so much per year for an infantry man, add to that dependent's allotments (many have more than one wife each with children), electricity in a major town they hold has always been free, then there are hospitals and schools to fund.. They control oil fields and need to pump like crazy to make ends meet.

It's a crazy world...

Lakewood90712

Thinks s/he gets paid by the post

- Joined

- Jul 21, 2005

- Messages

- 2,223

That could well be.

I heard an analysis today on NPR where one of those think-tank guys said that ISIS is running a huge deficit trying to manage territory. He described ISIS's military pay structure... so much per year for an infantry man, add to that dependent's allotments (many have more than one wife each with children), electricity in a major town they hold has always been free, then there are hospitals and schools to fund.. They control oil fields and need to pump like crazy to make ends meet.

It's a crazy world...

I would not be surprised if the more savvy paid combatants demand to be paid in US currency.

I've been hearing about "peak oil" since I was 20 years old. I'm now 64 and haven't seen it yet.

There is a credibility gap.

To be fair peak oil was reached in the United States in the 1970s as predicted by Hubbard (when you were 20

As for the long term, well. As they say: "the stone age came to an end not for lack of stones". Just as well, the alternative is not so good.

Peak oil/gas demand will be the real cause of peak oil/gas production. Investments are being scaled back quite a lot in the world, a.o. because of that effect already taking hold.

Disclosure: I also hold some oil/gas shares. The oil era will end eventually, but there's still good money to be made I believe in the mean time.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

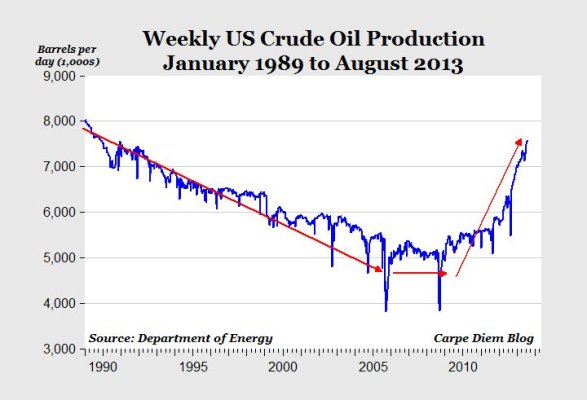

+1. Fossil fuels demand will outstrip supply eventually, but it now appears it'll be (much) later thanks to fracking and other geopolitical developments. Where I once expected major changes in my lifetime, now I wouldn't be surprised it it comes later, who knows.To be fair peak oil was reached in the United States in the 1970s as predicted by Hubbard (when you were 20), and most of the reason the peak has been delayed is due to better extraction technologies.

As for the long term, well. As they say: "the stone age came to an end not for lack of stones". Just as well, the alternative is not so good.

Peak oil/gas demand will be the real cause of peak oil/gas production. Investments are being scaled back quite a lot in the world, a.o. because of that effect already taking hold.

Disclosure: I also hold some oil/gas shares. The oil era will end eventually, but there's still good money to be made I believe in the mean time.

I also hold oil/gas (VGELX) but I don't expect it to be the no-brainer I once thought, and it was always a bet on the character of consumers more than the value of oil/gas IMO.

aja8888

Moderator Emeritus

+1. Fossil fuels demand will outstrip supply eventually, but it now appears it'll be (much) later thanks to fracking and other geopolitical developments. Where I once expected major changes in my lifetime, now I wouldn't be surprised it it comes later, who knows.

I also hold oil/gas (VGELX) but I don't expect it to be the no-brainer I once thought, and it was always a bet on the character of consumers more than the value of oil/gas IMO.

Point of clarification: We have been "fracking" wells since earlier than 1940. What's provided the largest improvement in extraction of existing oil and gas has been the perfection of horizontal drilling techniques and, on a smaller scale, the ability to drill in deeper offshore waters.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I thought they went hand in hand but I see you're right - thanks for the correction. US production has changed dramatically to say the least.Point of clarification: We have been "fracking" wells since earlier than 1940. What's provided the largest improvement in extraction of existing oil and gas has been the perfection of horizontal drilling techniques and, on a smaller scale, the ability to drill in deeper offshore waters.

Attachments

Point of clarification: We have been "fracking" wells since earlier than 1940. What's provided the largest improvement in extraction of existing oil and gas has been the perfection of horizontal drilling techniques and, on a smaller scale, the ability to drill in deeper offshore waters.

The term "fracking" is used so readily in the media and conversation, it has become almost a proxy for any endeavor involved in oil or gas drilling, adding to people's confusion. The sounds the word makes rolling off the tongue can be made to sound aggressive and sinister, giving it a larger role in drilling opposition statements.

An article appeared in the New Yorker magazine in 2011 detailing some of the story of the Bakken shale area, containing this quote that summarized for me the utility and near magic of horizontal drilling:

"Horizontal drilling has become extraordinarily precise. “If your house was ten thousand feet underground, these guys could bring a drill bit through the front door and out the back,” an oil-industry blogger wrote last year. Increasingly sophisticated sensors provide hundreds of calculations per minute as a drill bores ahead, dictating the angle at which to adjust the bit in order to maintain a graceful curve that won’t kink the pipe."

In spite of the range of issues that twist some people's tails about this latest frenzy of us oil production, this is technically pretty cool stuff, imo.

Kuwait on the Prairie - The New Yorker

Lakewood90712

Thinks s/he gets paid by the post

- Joined

- Jul 21, 2005

- Messages

- 2,223

The term "fracking" is used so readily in the media and conversation, it has become almost a proxy for any endeavor involved in oil or gas drilling, adding to people's confusion. The sounds the word makes rolling off the tongue can be made to sound aggressive and sinister, giving it a larger role in drilling opposition statements.

An article appeared in the New Yorker magazine in 2011 detailing some of the story of the Bakken shale area, containing this quote that summarized for me the utility and near magic of horizontal drilling:

"Horizontal drilling has become extraordinarily precise. “If your house was ten thousand feet underground, these guys could bring a drill bit through the front door and out the back,” an oil-industry blogger wrote last year. Increasingly sophisticated sensors provide hundreds of calculations per minute as a drill bores ahead, dictating the angle at which to adjust the bit in order to maintain a graceful curve that won’t kink the pipe."

In spite of the range of issues that twist some people's tails about this latest frenzy of us oil production, this is technically pretty cool stuff, imo.

Kuwait on the Prairie - The New Yorker

The only beef I have with widespread use of fracking is the huge amount of fresh water used , drawing down aquifers. Disposal of the fluid is no problem, as a lot of the holes drilled don't result in a productive well , so the contaminated water is put down those abandoned holes. I am satisfied with the safety of that.

We are using up fresh water that took hundreds of thousands of years to fill aquifers , to get the harder to get at oil. If oil is hard to live without , just try growing food without water.

I'm starting to rant. Will get off my soapbox now.

The only beef I have with widespread use of fracking is the huge amount of fresh water used , drawing down aquifers. Disposal of the fluid is no problem, as a lot of the holes drilled don't result in a productive well , so the contaminated water is put down those abandoned holes. I am satisfied with the safety of that.

We are using up fresh water that took hundreds of thousands of years to fill aquifers , to get the harder to get at oil. If oil is hard to live without , just try growing food without water.

I'm starting to rant. Will get off my soapbox now.

I take your point on the water. I have hoped that a method using gelled propane as a water substitute would gain traction, but cost is no doubt the big impediment. CO2 has sometimes been used, but must also be very limited as accounts of its use are rare.

Fracking doesn't stop with water...

My new nextdoor neighbor moved from his home near Utica IL... (Just down the road from us)... because of dynamiting, silica sand blowing through the neighborhood, and the 24/7 rumble of huge sand trucks.

The entire county is being affected by the expanded production. Positive side , jobs, negatives... loss of neighborhoods, increased road costs, tourism (Starved rock State Park), Illinois River barge traffic and potential ground stability problems.

In silica valley, the sand is moving - LaSalle News Tribune - LaSalle, IL

My new nextdoor neighbor moved from his home near Utica IL... (Just down the road from us)... because of dynamiting, silica sand blowing through the neighborhood, and the 24/7 rumble of huge sand trucks.

The entire county is being affected by the expanded production. Positive side , jobs, negatives... loss of neighborhoods, increased road costs, tourism (Starved rock State Park), Illinois River barge traffic and potential ground stability problems.

In silica valley, the sand is moving - LaSalle News Tribune - LaSalle, IL

aja8888

Moderator Emeritus

The only beef I have with widespread use of fracking is the huge amount of fresh water used , drawing down aquifers. Disposal of the fluid is no problem, as a lot of the holes drilled don't result in a productive well , so the contaminated water is put down those abandoned holes. I am satisfied with the safety of that.

We are using up fresh water that took hundreds of thousands of years to fill aquifers , to get the harder to get at oil. If oil is hard to live without , just try growing food without water.

I'm starting to rant. Will get off my soapbox now.

I'd love to compare the amounts of water used to keep lawns green vs. what's used in drilling and completing wells. Also, as far as "abandoned holes" go, today's 3D seismic and downhole logging techniques (and tools), lead to very few dry holes. Most new wells that are not turning out productive, never see a horizontal frac job. And most frac water these days is recovered during well completion and sent to a licensed injection facility for disposal. It's not the Wild, Wild West anymore, especially when it cost upwards of $11 - $12 million to drill and complete a new well.

Yes, I'm on the bandwagon, so to say, as I have been in the industry for 33 years and have seen a lot.

aja8888

Moderator Emeritus

Fracking doesn't stop with water...

My new nextdoor neighbor moved from his home near Utica IL... (Just down the road from us)... because of dynamiting, silica sand blowing through the neighborhood, and the 24/7 rumble of huge sand trucks.

The entire county is being affected by the expanded production. Positive side , jobs, negatives... loss of neighborhoods, increased road costs, tourism (Starved rock State Park), Illinois River barge traffic and potential ground stability problems.

In silica valley, the sand is moving - LaSalle News Tribune - LaSalle, IL

I honestly don't believe the "entire country" is being affected by an army of sand trucks rumbling by and blowing silica all over the landscape and other negative points you mention.

I have to agree that the upper midwest, especially Ohio in the Utica Shale area, is experiencing increased oil and gas production activity, but it's certainly not that big of a problem on the population. The areas with the greatest focus on new drilling (oil, not so much gas at the moment) are North Dakota, south and west Texas, and Oklahoma.

Your link requires a subscription to read the article.

Minnesota has some issues as well with digging for 'frac sand'.

While very few are being directly affected, the numbers aren't inconsequential.

Peak conventional oil happened. Technology has improved allowing as to get at more of the stuff. However, much of this new oil costs more to get, or carries bigger risks, or both.

Our economy is far too reliant on oil. There is a reason price spikes are almost always followed by recessions.

Lessening our society's dependance on oil is the best thing you can do for your retirement and future of your kids (ok, other than teaching them well).

While very few are being directly affected, the numbers aren't inconsequential.

Peak conventional oil happened. Technology has improved allowing as to get at more of the stuff. However, much of this new oil costs more to get, or carries bigger risks, or both.

Our economy is far too reliant on oil. There is a reason price spikes are almost always followed by recessions.

Lessening our society's dependance on oil is the best thing you can do for your retirement and future of your kids (ok, other than teaching them well).

Similar threads

- Replies

- 67

- Views

- 4K

- Replies

- 556

- Views

- 44K

- Replies

- 9

- Views

- 2K

Latest posts

-

-

-

-

-

-

-

-

Update on Cord Cutting (Cable TV) - 2021 version

- Latest: RetiredAndLovingIt

-