target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Total Portfolio Value

YTD Change

(50/45/5 target)

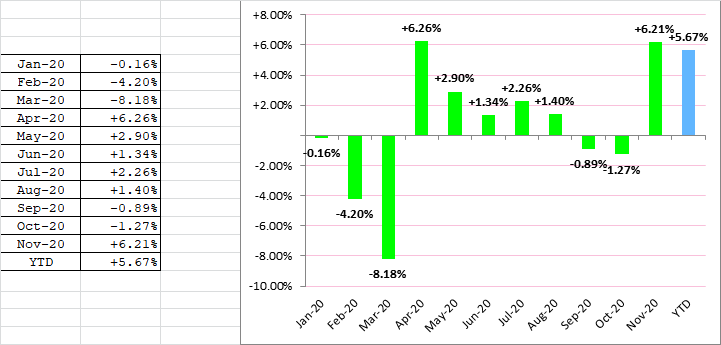

Nov-20 6.21%

YTD 5.67%

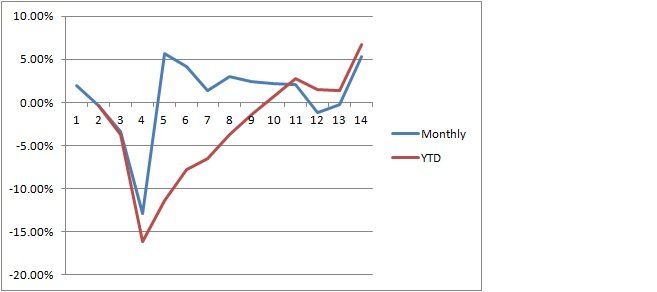

American Balanced Fund Class R-6 (RLBGX) is a managed index fund which is similar to our target, and we use it to estimate our portfolio return.

Year-to-Date Return 5.18%

Overall Portfolio Composition (%)

Cash 13.12%

Stocks 54.94%

Bonds 31.08%

Preferred 0.11%

Convertable 0.58%