Markola

Thinks s/he gets paid by the post

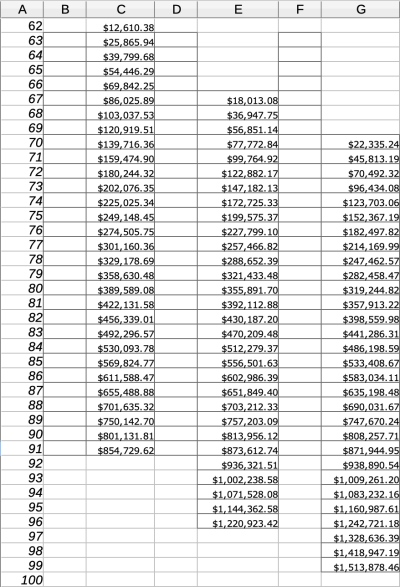

Its title is hyperbole but this article lays out concisely and cleanly the trade offs around taking SS at 62, Full Retirement Age (FRA) or age 70. Circumstances willing, DW and I are aiming for 70 when, according to this article and other calculators, we can claim 132% of the FRA amount.

https://www.fool.com/amp/retirement...mportant-social-security-chart-youll-eve.aspx

https://www.fool.com/amp/retirement...mportant-social-security-chart-youll-eve.aspx

Last edited: