Tiger8693

Full time employment: Posting here.

I pretty much started retirement savings in March 2000 when I changed jobs, and transferred about $50k into a new company 401k. Since that time, I am now surpassing $850k in just 401k retirement accounts, but have started some after tax accounts that I plan to build for no "reduced taxable income distributions" with about $125k, have a defined contribution pension worth about $85k, and an HSA that at this points has ~$32k.

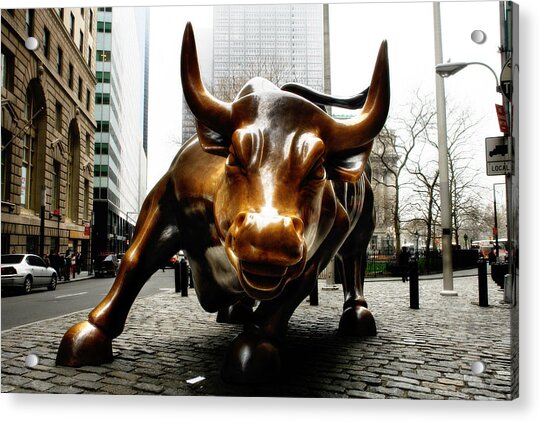

So, all in I can claim the "millionaire" club.

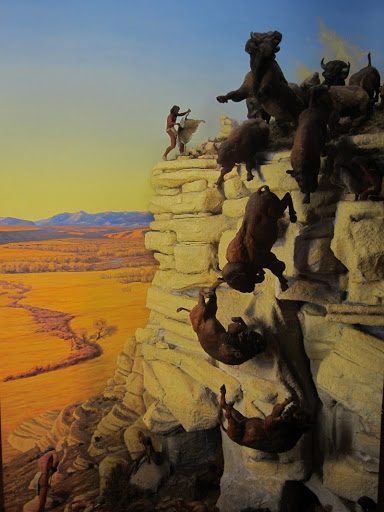

Still a ways to go though.

So, all in I can claim the "millionaire" club.

Still a ways to go though.