Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Looks like we will be off pretty sharply here at the open.

Looks like we will be off pretty sharply here at the open.

Looking like it.

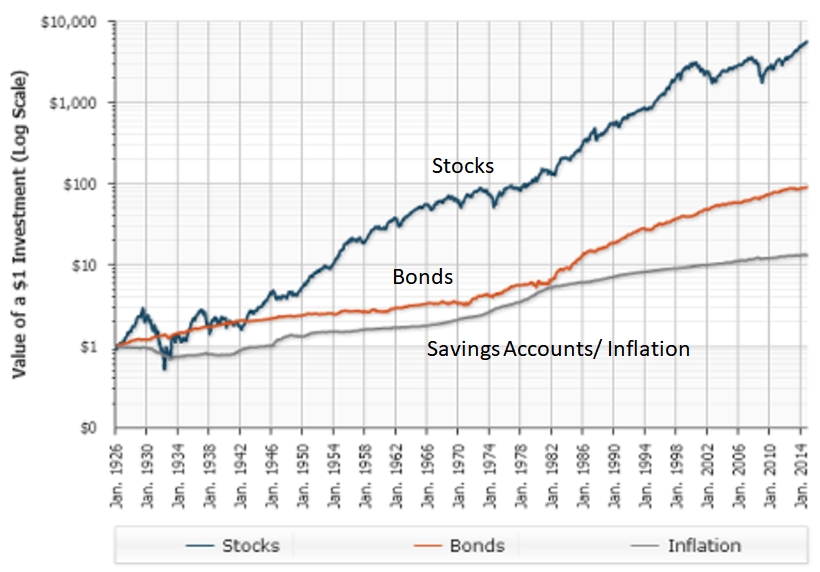

Exactly. There has never been a drop that has not been followed by a recovery.... The market goes down, then up, then down, then up again. Over the medium and long term, the market goes up. Who cares if it drops 5%?

Selling puts.Agreed - nice 2% drop in the Nasdaq to jump in on some broad tech index or somethin'. What are you guys buying?

Down 1.5-2% across the various market indexes about 1 hour in. Not doing anything myself, just watching with a little interest. Mainly my engineering background and wanting to figure out the reasons behind the market moves, which goes for both directions. But today looks like a down day for sure.

Selling puts.

Now down 2.6 %.

Starting to get interesting….

Only $300 Billion US in default....heck Xi can cover that with spare change. But he won't bail out the foreign holders. That will be done by the "J Team" and other Central Banks!

Plus, the properties in default (when that happens) will be sold to recoup the losses.

I been selling scrap steel for 200$ a ton. You telling me those days are ovah?I heard that only $30B, or 10% of the loan, is owned by foreign investors. And then, there are creditors other than US banks.

But is this just the tip of the iceberg? Evergrande is only the 2nd-ranked Chinese real-estate developer. As Buffett famously said during the US subprime crisis, "only when the tide is out that we know who has been swimming nekkid".

About selling unfinished properties to raise money, China already has a huge stockpile of finished and unfinished properties, actually entire ghost cities, sitting there rotting away for years with no takers. Who wants these recent skeletons of high-rise buildings?

This will crimp China economic growth. They will need less steel, copper, etc... A US steel maker that I hold was pummeled down nearly 10% today. Not that it exports to China, but the steel price gets hammered, and whole industries become collateral damages. Will the Chinese consumers be buying EVs soon? The pain is going to spread.

Aye, aye, aye... Buy, buy, buy?

I been selling scrap steel for 200$ a ton. You telling me those days are ovah?